UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

ANTERO RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: | |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: | |

|

JUNE 17, 2020 8:30 A.M. Mountain Time

Antero Principal Executive Offices 1615 Wynkoop Street Denver, CO 80202

|

|

NOTICE of 2020 Annual Meeting of Shareholders |

The 2020 Annual Meeting of Shareholders of Antero Resources Corporation (“Antero”) will be held on Wednesday, June 17, 2020, at 8:30 A.M. Mountain Time, at our principal executive offices at 1615 Wynkoop Street, Denver, CO 80202. The Annual Meeting is being held for the following purposes:

AGENDA

| 1. | Elect the three Class I members of Antero Resources Corporation’s Board of Directors (the “Board”) named in this Proxy Statement to serve until Antero’s 2023 Annual Meeting of Shareholders; |

| 2. | Ratify the appointment of KPMG LLP as Antero’s independent registered public accounting firm for the year ending December 31, 2020; |

| 3. | Approve, on an advisory basis, the compensation of Antero’s named executive officers; |

| 4. | Approve the Antero Resources Corporation 2020 Long-Term Incentive Plan; |

| 5. | Approve an amendment and restatement of Antero’s Certificate of Incorporation (our “Charter”) to (a) effect a reverse stock split that will reduce the number of shares of outstanding common stock in accordance with a ratio to be determined by the Board within a range of one share of common stock for every 5 to 20 shares of common stock (or any number in between) currently outstanding; and (b) reduce by a corresponding proportion the number of authorized shares of common stock and preferred stock (collectively, the “Reverse Stock Split”); and |

| 6. | Transact other such business as may properly come before the meeting and any adjournment or postponement thereof. |

These proposals are described in the accompanying proxy materials.

RECORD DATE

April 22, 2020

By order of the Board of Directors,

Glen C. Warren, Jr.

President, Chief Financial Officer and Secretary

WHO MAY VOTE:

You will be able to vote at the Annual Meeting—either in person or by proxy—only if you were a shareholder of record at the close of business on April 22, 2020, the record date for the Annual Meeting. The Board requests your proxy for the Annual Meeting, which will authorize the individuals named in the proxy to represent you and vote your shares at the Annual Meeting or any adjournment or postponement thereof.

HOW TO RECEIVE ELECTRONIC DELIVERY OF FUTURE ANNUAL MEETING MATERIALS:

Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to provide access to our proxy solicitation materials electronically, rather than mailing paper copies of these materials to each shareholder. Beginning on April 27, 2020, we will mail to each shareholder a Notice of Internet Availability of Proxy Materials with instructions on how to access the proxy materials, vote, or request paper copies.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 17, 2020:

This Notice of Annual Meeting and Proxy Statement and the Form 10-K are available on our website free of charge at www.anteroresources.com in the “SEC Filings” subsection of the “Investors” section.

YOUR VOTE IS IMPORTANT

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

We intend to hold the Annual Meeting in person. However, we are actively monitoring the impacts of COVID-19. In the event we believe it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication. Please monitor our website at www.anteroresources.com for updated information. If you are planning to attend the Annual Meeting, please check our website ten days prior to the meeting date. If we hold the Annual Meeting partially or solely by means of remote communication, it is currently our intent to resume in-person meetings with our 2021 Annual Meeting and thereafter, assuming normal circumstances. As always, we encourage you to vote your shares prior to the Annual Meeting.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |  |

|

|

| ||||

| If you are a registered shareholder as of the record date, you may vote your shares or submit a proxy to have your shares voted by one of the following methods: | INTERNET Use the website listed on the Notice of Internet Availability (the “Notice”) |

BY TELEPHONE Use the toll-free number listed on the Notice |

BY MAIL Sign, date and return your proxy card in the provided pre-addressed envelope |

IN PERSON Vote in person by completing a ballot at the Annual Meeting. See page 6 of the Proxy Statement for instructions on how to attend |

|

- 2020 Proxy Statement | 3 |

|

- 2020 Proxy Statement | 4 |

|

- 2020 Proxy Statement | 5 |

2020 Annual Meeting of Shareholders

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Antero Resources Corporation (“Antero” or the “Company”) for use at the 2020 Annual Meeting of Shareholders (the “Annual Meeting”).

| DATE: | Wednesday, June 17, 2020 |

| TIME: | 8:30 A.M. Mountain Time |

| LOCATION: | 1615 Wynkoop Street, Denver, CO 80202 |

| RECORD DATE: | April 22, 2020 |

How to Vote

If you are a registered shareholder as of the record date, you may vote your shares or submit a proxy to have your shares voted by one of the following methods:

| • | Online. Submit a proxy electronically using the website listed on the Notice of Internet Availability (the “Notice”). Please have the Notice handy when you log on to the website. Internet voting facilities will be available until 11:59 p.m., Mountain Time, on Tuesday, June 16, 2020. |

| • | By Telephone. Access the proxy materials and submit a proxy by telephone using the toll-free number listed on the Notice. Please have the Notice handy when you call. Telephone voting facilities will be available until 11:59 p.m., Mountain Time, on Tuesday, June 16, 2020. |

| • | By Mail. You may request a hard copy proxy card by following the instructions on the Notice. You can submit your proxy by signing, dating and returning your proxy card in the provided pre-addressed envelope. |

| • | In Person. If you are a registered shareholder and you attend the Annual Meeting, you may vote in person by completing a ballot. If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper proxy. Attending the meeting without completing a ballot will not count as a vote. |

If you are a beneficial shareholder (meaning your shares are held in “street name” by a broker or bank as of the record date), you will receive instructions from the holder of record that you must follow for your shares to be voted. Most banks and brokers offer Internet and telephone voting. If you do not give voting instructions, your broker will not be permitted to vote your shares on any matter that comes before the Annual Meeting except the ratification of our auditors.

As of the record date, 268,390,401 shares of common stock were outstanding and entitled to be voted at the Annual Meeting.

Attending the Annual Meeting

All holders of our common stock as of the record date and individuals holding valid proxies from such shareholders are invited to attend the Annual Meeting. To gain entrance to the meeting, you must present valid, government-issued photo identification. If you are a registered holder, you also must have your proxy card (if you requested printed materials) or your Notice. If you are a beneficial shareholder, you also must have a letter from your bank or broker or a brokerage statement evidencing ownership of Antero shares as of the record date. Anyone purporting to serve as a proxy will be required to present a valid written proxy from the registered holder. If you are a beneficial shareholder and you would like to vote in person at the meeting, you must present a valid written proxy from your broker, bank, or other nominee.

|

- 2020 Proxy Statement | 6 |

We intend to hold the Annual Meeting in person. However, we are actively monitoring the impacts of COVID-19. In the event we believe it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication. Please monitor our website at www.anteroresources.com for updated information. If you are planning to attend the Annual Meeting, please check our website ten days prior to the meeting date. If we hold the Annual Meeting partially or solely by means of remote communication, it is currently our intent to resume in-person meetings with our 2021 Annual Meeting and thereafter, assuming normal circumstances. As always, we encourage you to vote your shares prior to the Annual Meeting.

|

- 2020 Proxy Statement | 7 |

Current Directors and Board Nominees

| Committee Memberships | ||||||||||||||||

| Name and Age | Director Class and Occupation | Director Since | Independent | Audit | Comp | Nom & Gov | Conflicts | ESG* | ||||||||

| Paul M. Rady Age: 66 | Class I Director Nominee Chairman of the Board and Antero Resources Chief Executive Officer | 2004 | ||||||||||||||

| Glen C. Warren, Jr. Age: 64 | Class I Director Nominee Antero Resources President, Chief Financial Officer, Secretary | 2004 | ||||||||||||||

| Thomas B. Tyree, Jr. Age: 59 | Class I Director Nominee Executive Chairman of Extraction Oil & Gas, Inc. and Chairman of Northwoods Energy LLC | 2019 |  |  |  |  | ||||||||||

| W. Howard Keenan, Jr. Age: 69 | Class II Director Member of Yorktown Partners LLC | 2004 |  |  | ||||||||||||

| Paul J. Korus Age: 63 | Class II Director Retired Senior Vice President and Chief Financial Officer of Cimarex Energy | 2018 |  |  |  |  |  | |||||||||

| Jacqueline C. Mutschler Age: 58 | Class II Director Independent Executive Consultant | 2020 |  |  |  |  | ||||||||||

| Robert J. Clark Age: 75 | Class III Director Chairman and Chief Executive Officer of 3 Bear Energy, LLC | 2013 |  |  |  |  |  | |||||||||

| Benjamin A. Hardesty Age: 70 | Class III Director, Lead Director Owner of Alta Energy LLC | 2013 |  |  |  |  | ||||||||||

| Vicky Sutil Age: 55 | Class III Director Independent Director, Delek US Holdings, Inc. | 2019 |  |  |  |  | ||||||||||

|

Chairperson |

| * | Environment, Sustainability and Social Governance (ESG) Committee |

2019 Business Performance Highlights and Incentive Plan Results

2019 was a year of significant accomplishment for the Company in which we delivered on our shareholder strategy, including:

| • | Focused on return on invested capital |

| • | Achieved another year of double-digit production growth per debt adjusted share |

| • | Returned $39 million of capital to shareholders through our share repurchase program |

| • | Reduced drilling and completion capital 9% from 2019 original guidance levels, while achieving production above the midpoint of 2019 guidance |

| • | Continued to focus on operating safely with industry-leading Total Recordable Incident Rate |

Annual Incentive Plan Results. Our performance for 2019 resulted in a payout calculation of 70.833%. The Compensation Committee reduced the payouts for Messrs. Rady and Warren to 64.21% and 64.23%, respectively, to adjust for current market conditions. The full details of our annual incentive plan metrics, goals and results are shown on page 37 of this Proxy Statement.

|

- 2020 Proxy Statement | 8 |

Antero and the Board value input from Antero’s shareholders and we are committed to maintaining an open dialogue to receive feedback on items that are important to them. In 2019, we reached out to a significant number of shareholders, offering either a call or an in-person meeting to discuss governance-related issues, including environmental and social matters, and compensation. Most of those contacted declined our invitation, indicating they are satisfied with our programs and practices.

Corporate Governance Highlights

Our initial group of directors consisted of management and our private equity sponsors. At the time of our initial public offering in 2013, we added three independent directors. We looked for skills in these directors that would help us as a public company, such as technical accounting and auditing, industry experience, and experience in our area of operation.

The Board continues to look for specific skill sets when identifying and evaluating prospective nominees, and also considers personal and professional diversity. Paul Korus was added to the Board in December 2018, became the chair of our Audit Committee following Richard Connor’s resignation in January 2019 and currently also serves on our Compensation Committee, our Nominating & Governance Committee and our Conflicts Committee. Vicky Sutil and Thomas B. Tyree, Jr. were added to the Board in October 2019 and Jacqueline C. Mutschler was added to the Board in March 2020. Mr. Tyree was appointed to serve on our Audit Committee, Compensation Committee and Conflicts Committee, where he replaced Robert J. Clark, Benjamin A. Hardesty and Joyce E. McConnell, respectively, and Ms. Sutil was appointed to serve on our Compensation Committee, where she replaced Joyce E. McConnell, and our Nominating & Governance Committee. Ms. Mutschler was appointed to serve on our Audit Committee and our Conflicts Committee. In addition, the Board established the Environment, Sustainability and Social Governance (ESG) Committee in April 2020, with Ms. Sutil serving as the chair and Ms. Mutschler and Messrs. Hardesty and Clark serving as committee members. The Board is pleased that the addition of these new directors broadened the Board’s talent, experience, and diversity. Furthermore, in 2019, each of James R. Levy, Peter R. Kagan and Joyce E. McConnell resigned from the Board, with Messrs. Levy and Kagan resigning following the divestiture of Warburg Pincus’ remaining interests in Antero, and Ms. McConnell resigning to focus her attention on serving as the President of Colorado State University. The timeline below shows how the Board has evolved.

| Paul M. Rady Glen C. Warren, Jr. Peter R. Kagan* W. Howard Keenan, Jr. |

James R. Levy* Richard W. Connor* Robert J. Clark Benjamin A. Hardesty |

Joyce E. McConnell* Paul J. Korus |

Vicky Sutil Thomas B. Tyree, Jr. |

Jacqueline C. Mutschler | |||||

| |||||||||

| 2004 | 2013 | 2018 | 2019 | 2020 | |||||

| Antero Resources was formed | Launched the Initial Public Offering | ||||||||

* No longer on the Board | |||||||||

|

- 2020 Proxy Statement | 9 |

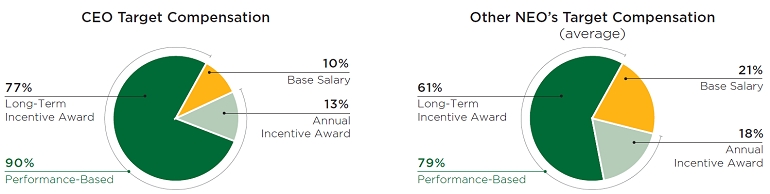

Executive Compensation Highlights

Below is a summary of key components and decisions regarding our executive compensation program for 2019:

| • | Long-term incentive compensation remained 100% performance-based for CEO and CFO based on rigorous absolute TSR performance hurdles |

| • | Maximum bonus payout opportunity reduced to 150% from 200% of target |

| • | The Compensation Committee applied negative discretion to the bonus payouts for the CEO and CFO |

| • | Base salary levels for the CEO and CFO were not increased |

| • | Performance awards with performance period ending in 2019 paid out at 0% of target |

| • | As of December 31, 2019, realizable value of CEO’s outstanding 3-year long-term incentive grants from 2017, 2018 and 2019 is 96% lower than the target value at the time of grant |

| • | Annual incentive plan metrics selected in response to shareholder feedback and alignment with our business strategy |

| • | Rigorous goal setting for annual incentive plan metrics, including more challenging levels for threshold goals relating to debt-adjusted net production growth per share and free cash flow |

|

- 2020 Proxy Statement | 10 |

| ITEM ONE: | ELECTION OF DIRECTORS |

The Board is divided into three classes. Directors in each class are elected to serve for three-year terms and until either they are re-elected or their successors are elected and qualified, or until their earlier resignation or removal. Each year, the directors of one class stand for re-election as their terms of office expire. Based on recommendations from our Nominating & Governance Committee, the Board has nominated the following individuals for election as Class I directors of Antero with terms to expire at the 2023 Annual Meeting of Shareholders, barring an earlier resignation or removal:

| • | Paul M. Rady |

| • | Glen C. Warren, Jr. |

| • | Thomas B. Tyree, Jr. |

All nominees currently serve as Class I directors of Antero. Their biographical information is contained in “Directors” below.

The Board has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the size of the Board will be reduced or the individuals acting under your proxy will vote for the election of a substitute nominee recommended by the Board.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

|

- 2020 Proxy Statement | 11 |

We were originally formed in 2004 as Antero Resources II Corporation. Through a series of internal reorganization transactions, Antero Resources II Corporation’s successor and certain of its affiliates were merged with and into Antero Resources Appalachian Corporation. That entity was renamed Antero Resources Corporation in June 2013 in connection with our initial public offering.

Set forth below is the background, business experience, attributes, qualifications and skills of each Antero director and director nominee. In some cases, references to our directors’ tenure with Antero date back to our original formation in 2004.

Class I Directors Seeking Reelection

|

Paul M. Rady

Age: 66 Director Since: 2004 Chief Executive Officer and Chairman Committee Memberships: None |

Key Skills, Attributes and Qualifications:

| • | Chief Executive Officer and Chairman since May 2004 | |

| • | Served as Chief Executive Officer and Chairman of Antero’s predecessor company from its founding in 2002 to its ultimate sale to XTO Energy, Inc. in 2005 | |

| • | Chief Executive Officer and Chairman of the Board of Directors of Antero Midstream Corporation | |

| • | Served as President, CEO and Chairman of Pennaco Energy from 1998 until its sale to Marathon in 2001 | |

| • | Worked with Barrett Resources from 1990 until 1998, moving from Chief Geologist to Exploration Manager, EVP Exploration; President, COO and Director; and ultimately CEO | |

| • | Began his career with Amoco, where he served ten years as a geologist focused on the Rockies and Mid-Continent |

Has significant experience as a chief executive of oil and gas companies, together with his training as a geologist and broad industry knowledge.

Other Public Company Boards:

| • | Antero Midstream Corporation; Antero Midstream Partners LP (until March 2019) |

|

- 2020 Proxy Statement | 12 |

|

Glen C. Warren, Jr.

Age: 64 Director Since: 2004 President, Chief Financial Officer and Secretary Committee Memberships: None |

Key Skills, Attributes and Qualifications:

| • | President, Chief Financial Officer and Secretary since May 2004 | |

| • | Served as President, Chief Financial Officer and Secretary and as a director of Antero’s predecessor company from its founding in 2002 to its ultimate sale to XTO Energy, Inc. in 2005 | |

| • | Serves as President and Secretary and as a member of the Board of Directors of Antero Midstream Corporation | |

| • | Served as EVP, CFO and Director of Pennaco Energy from 1998 until its sale to Marathon in 2001 | |

| • | Spent ten years as a natural resources investment banker focused on equity and debt financing and M&A advisory with Lehman Brothers, Dillon Read & Co. Inc. and Kidder, Peabody & Co. | |

| • | Began his career as a landman in the Gulf Coast region with Amoco, where he spent six years |

Has significant experience as a chief financial officer of oil and gas companies, together with his experience as an investment banker and broad industry knowledge.

Other Public Company Boards:

| • | Antero Midstream Corporation; Antero Midstream Partners LP (until March 2019) |

|

Thomas B. Tyree, Jr.

Age: 59 Director Since: 2019 Committee Memberships: Audit Committee, Compensation Committee, Conflicts Committee |

Key Skills, Attributes and Qualifications:

| • | Executive Chairman of Extraction Oil & Gas, Inc., an upstream oil and gas company, beginning in March 2020 | |

| • | Chairman of Northwoods Energy LLC, an upstream oil and gas company that he co-founded in 2018 | |

| • | From 2006 to 2016, served as President, Chief Financial Officer and as a Director of Vantage Energy, LLC | |

| • | From 2003 to 2006, served as Chief Financial Officer of Bill Barrett Corporation | |

| • | Investment banker at Goldman, Sachs & Co. from 1989 to 2003 |

Has significant experience in the oil and gas industry over a number of decades.

Other public company boards:

| • | Extraction Oil & Gas, Inc.; Bonanza Creek Energy, Inc. (until March 2020) |

|

- 2020 Proxy Statement | 13 |

|

W. Howard Keenan, Jr.

Age: 69 Director Since: 2004 Committee Memberships: Nominating & Governance Committee |

Key Skills, Attributes and Qualifications:

| • | Since 1997, has been a Member of Yorktown Partners LLC, a private investment manager focused on the energy industry | |

| • | From 1975 to 1997, was in the Corporate Finance Department of Dillon, Read & Co. Inc. and active in the private equity and energy areas, including the founding of the first Yorktown Partners fund in 1991 | |

| • | Serves on the boards of directors of multiple Yorktown Partners portfolio companies | |

| • | Serves on the Board of Directors of Antero Midstream Corporation |

Has over forty years of experience with energy companies and investments and broad knowledge of the oil and gas industry.

Other Public Company Boards:

| • | Solaris Oilfield Infrastructure, Inc., Brigham Minerals, Inc., Antero Midstream Corporation, Ramaco Resources, Inc. (until June 2019), Antero Midstream Partners LP (until March 2019), Concho Resources (until 2013), Geomet Inc. (until 2012) |

|

Paul J. Korus

Age: 63 Director Since: 2018 Committee Memberships: Audit Committee (chair), Compensation Committee, Nominating & Governance Committee, Conflicts Committee |

Key Skills, Attributes and Qualifications:

| • | Senior Vice President and Chief Financial Officer of Cimarex Energy, an exploration & production company with operations in Oklahoma, Texas and New Mexico from 2002 until retirement in 2015 | |

| • | Senior Vice President and Chief Financial Officer of Key Production Company, an exploration and production company, from 1999 to 2002, until it was acquired by Cimarex Energy | |

| • | Senior Research Analyst with Petrie Parkman & Co. before merger with Merrill Lynch | |

| • | Previously served as Chairman of University of North Dakota business school advisory counsel |

Has over 35 years of experience in the oil and natural gas industry.

Other Public Company Boards:

| • | PDC Energy, Inc., SRC Energy Inc. (until January 2020), Antero Midstream Partners LP (until March 2019) |

|

- 2020 Proxy Statement | 14 |

|

Jacqueline C. Mutschler

Age: 58 Director Since: 2020 Committee Memberships: Audit Committee, Conflicts Committee, Environment, Sustainability and Social Governance (ESG) Committee |

Key Skills, Attributes and Qualifications:

| • | Independent Executive Consultant for the energy and technology sectors since 2014 | |

| • | Member of Weir Group plc Technology Advisory Board from 2015 to 2017 | |

| • | From 2006 until retirement in 2014, served as BP plc Senior Vice President Exploration and Production Technology | |

| • | Held BP Vice President domestic and international roles between 2001 and 2006, including U.S. unconventional gas production | |

| • | From 1986 to 2001 held production management, financial business planning and geophysical roles for BP Onshore U.S. and Gulf of Mexico businesses |

Has over 30 years of experience in the oil and natural gas industry, including 28 years with BP plc.

Other public company boards:

| • | Weatherford International plc |

|

Robert J. Clark

Age: 75 Director Since: 2013 Committee Memberships: Compensation Committee (chair), Nominating & Governance Committee, Conflicts Committee (chair), Environment, Sustainability and Social Governance (ESG) Committee |

Key Skills, Attributes and Qualifications:

| • | Chairman of 3 Bear Energy, LLC, a midstream energy company with operations in the Rocky Mountains, since its formation in March 2013 and Chief Executive Officer of 3 Bear Energy, LLC until 2019 | |

| • | Formed, operated and subsequently sold Bear Tracker Energy in 2013 (to Summit Midstream Partners, LP); a portion of Bear Cub Energy in 2007 (to Regency Energy Partners, L.P.), and the remaining portion in 2008 (to GeoPetro Resources Company); and Bear Paw Energy in 2001 (to ONEOK Partners, L.P., formerly Northern Border Partners, L.P.) | |

| • | Member of the Board of Directors of Children’s Hospital Colorado Foundation, the Boys and Girls Club of Metro Denver and Judi’s House, a Denver charity for grieving children and families |

Has significant experience with energy companies, with over 45 years of experience in the industry.

|

- 2020 Proxy Statement | 15 |

|

Benjamin A Hardesty (Lead Director)

Age: 70 Director Since: 2013 Committee Memberships: Nominating & Governance Committee (chair), Audit Committee, Environment, Sustainability and Social Governance (ESG) Committee |

Key Skills, Attributes and Qualifications:

| • | Has been the owner of Alta Energy LLC, a consulting business focused on oil and natural gas in the Appalachian Basin and onshore United States, since May 2010 | |

| • | President of Dominion E&P, Inc., a subsidiary of Dominion Resources Inc. engaged in the exploration and production of natural gas in North America, from September 2007 until retirement in May 2010. Joined Dominion in 1995 and served as president of Dominion Appalachian Development, Inc. until 2000 and general manager and vice president—Northeast Gas Basins until 2007 | |

| • | Member of the Board of Directors of Blue Dot Energy Services, LLC from 2011 until its sale to B/E Aerospace, Inc. in 2013 | |

| • | From 1982 to 1995, served successively as vice president, executive vice president and president of Stonewall Gas Company, and from 1978 to 1982, served as vice president, operations of Development Drilling Corp. | |

| • | Served as an active duty officer in the U.S. Army Security Agency for two years and as a reserve officer | |

| • | Director emeritus and past president of the West Virginia Oil & Natural Gas Association and past president of the Independent Oil & Gas Association of West Virginia | |

| • | Trustee and past chairman of the Nature Conservancy of West Virginia and a member of the Board of Directors of the West Virginia Chamber of Commerce | |

| • | Serves as a member of the Visiting Committee of the West Virginia School of Petroleum and Natural Gas Engineering Department of Statler College of Engineering and Mineral Resources at West Virginia University |

Has significant experience in the oil and natural gas industry, including in Antero’s areas of operation.

Other Public Company Boards:

| • | KLX Energy Services Holdings, Inc.; KLX Inc. (until October 2018) |

|

Vicky Sutil

Age: 55 Director Since: 2019 Committee Memberships: Environment, Sustainability and Social Governance (ESG) Committee (chair), Compensation Committee, Nominating & Governance Committee |

Key Skills, Attributes and Qualifications:

| • | From July 2017 to January 2020, worked with SK E&P Company focusing on strategic planning | |

| • | From 2014 to 2016 served as Vice President of Commercial Analysis for CRC Marketing, Inc. | |

| • | From 2000 to 2014 worked with Occidental Petroleum Corporation in different capacities including roles in corporate development, mergers and acquisitions and financial planning | |

| • | Other experience includes ARCO Products Company and Mobil Oil Corporation working as a project engineer and business analyst in the refining and marketing divisions |

Has significant experience in the oil and gas industry, including a background in corporate development, commercial negotiations, corporate planning and project management.

Other Public Company Boards:

| • | Delek US Holdings, Inc., Plains All American Pipeline, L.P. (until 2015), Plains GP Holdings, L.P. (until 2015) |

|

- 2020 Proxy Statement | 16 |

Corporate Governance Guidelines

Antero’s sound governance practices and policies provide an important framework to assist the Board in fulfilling its duties to shareholders. Antero’s Corporate Governance Guidelines include provisions concerning the following:

| • | size of the Board; | |

| • | qualifications, independence, responsibilities, tenure, and compensation of directors; | |

| • | service on other boards; | |

| • | director resignation process; | |

| • | role of Chairman of the Board and the Lead Director (if any); | |

| • | meetings of the Board and meetings of independent directors; | |

| • | interaction of the Board with external constituencies; | |

| • | annual performance reviews of the Board; | |

| • | director orientation and continuing education; | |

| • | attendance at meetings of the Board and the Annual Meeting; | |

| • | shareholder communications with directors; | |

| • | committee functions, committee charters, and independence of committee members; | |

| • | director access to independent advisors and management; and | |

| • | management evaluation and succession planning. |

The Corporate Governance Guidelines are available on Antero’s website at www.anteroresources.com in the “Governance” subsection of the “Investors” section. The Nominating & Governance Committee reviews the Corporate Governance Guidelines periodically and as necessary, and any proposed additions to or amendments of the Corporate Governance Guidelines are presented to the Board for its approval.

Rather than adopting categorical standards, the Board assesses director independence on a case-by-case basis, in each case consistent with applicable legal requirements and the listing standards of the New York Stock Exchange (NYSE). After reviewing all relationships each director has with Antero, including the nature and extent of any business relationships, as well as any significant charitable contributions Antero makes to organizations where its directors serve as board members or executive officers, the Board has affirmatively determined that the following directors have no material relationships with Antero and are independent as defined by NYSE listing standards: Messrs. Clark, Hardesty, Keenan, Korus and Tyree and Mmes. Mutschler and Sutil. Neither Mr. Rady, Antero’s CEO, nor Mr. Warren, Antero’s President and CFO, is considered by the Board to be an independent director. Messrs. Connor, Levy and Kagan and Ms. McConnell were determined to be independent during their tenures as directors.

|

- 2020 Proxy Statement | 17 |

Antero does not have a formal policy addressing whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. The directors serving on the Board have considerable professional and industry experience, significant experience as directors of both public and private companies, and a unique knowledge of the challenges and opportunities Antero faces. Accordingly, the Board believes it is in the best position to evaluate Antero’s needs and to determine how best to organize Antero’s leadership structure to meet those needs at any given time.

At present, the Board has chosen to combine the positions of Chairman and Chief Executive Officer. The Board believes the current Chief Executive Officer is the individual with the necessary experience, commitment, and support of the other members of the Board to effectively carry out the role of Chairman. Mr. Rady brings valuable insight to the Board due to the perspective and experience he brings both as our Chief Executive Officer and as one of our founders. As the principal executive officer since our inception, Mr. Rady has unparalleled knowledge of our business and operations. As a significant stockholder, Mr. Rady is invested in our long-term success. In addition, the Board believes that combining the roles of Chairman and CEO at the present time promotes strong alignment of strategic development and execution, effective implementation of strategic initiatives, and clear accountability for Antero’s success or failure. Moreover, because seven of the nine directors are independent under NYSE rules, the Board believes this leadership structure does not impede independent oversight of Antero.

The Nominating & Governance Committee reviews this leadership structure every year. The Board believes it is important to retain the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be separated or combined.

Executive Sessions; Election of Lead Director

To facilitate candid discussion among Antero’s directors, the non-management directors meet in regularly scheduled executive sessions.

Pursuant to the Corporate Governance Guidelines, the Board, based on the recommendation of the Nominating & Governance Committee, is permitted to choose a Lead Director to preside at these executive sessions. Upon the resignation of Mr. Kagan on June 12, 2019, the Board elected Mr. Hardesty to serve in this role. As the Lead Director, Mr. Hardesty provides, in conjunction with the Chairman, leadership and guidance to the Board. He also chairs executive sessions of the non-management directors and establishes the agenda for these meetings.

How Director Nominees are Selected

Renominating incumbent directors

Before recommending to the Board that an existing director be nominated for reelection at the annual meeting of shareholders, the Nominating & Governance Committee will review and consider the director’s:

| • | past Board and committee meeting attendance and performance; | |

| • | length of Board service; | |

| • | personal and professional integrity, including commitment to Antero’s core values; | |

| • | relevant experience, skills, qualifications and contributions to the Board; and | |

| • | independence under applicable standards. |

|

- 2020 Proxy Statement | 18 |

Appointing new directors and filling vacancies

The Board believes that all directors should have sound business judgment, personal and professional integrity, an ability to work as part of a team, willingness to commit the required time to serve as a Board member, business experience, and financial literacy. Although the Board does not have a formal policy on diversity, the Nominating & Governance Committee identifies diversity as a factor it considers, along with other factors, in reviewing director candidates.

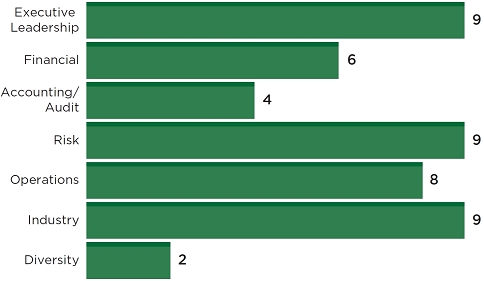

The Board created a detailed matrix to formalize the process of selecting new directors. The matrix pinpoints:

| • | areas where the current Board is strong, | |

| • | areas where the current Board could be enhanced, and | |

| • | qualities that all of Antero’s directors should have. |

Currently, the Board embodies a diverse set of experiences, qualifications, attributes, and skills as shown below:

The Nominating & Governance Committee will treat informal recommendations for directors that are received from Antero’s shareholders in the same manner as recommendations received from any other source.

Majority Vote Director Resignation Policy

Directors are elected by a plurality of votes cast in an uncontested election. The Corporate Governance Guidelines require that an incumbent director who fails to receive the required number of votes for reelection must tender a resignation. The Nominating & Governance Committee will act on an expedited basis to determine whether to accept any such resignation, and will submit its recommendation for prompt consideration by the Board. The Board expects the director whose resignation is under consideration to abstain from participating in this decision. The Nominating & Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation.

|

- 2020 Proxy Statement | 19 |

Board’s Role in Risk Oversight

In the normal course of its business, Antero is exposed to a variety of risks, including market risks relating to changes in commodity prices, interest rate risks, technical risks affecting Antero’s resource base, political risks, and credit and investment risk. The Board and each of its committees has distinct responsibilities for monitoring those risks, as shown below.

| The Board of Directors | ||||

| The Board oversees Antero’s strategic direction. To that end, the Board considers the potential rewards and risks of Antero’s business opportunities and challenges, and it monitors the development and management of risks that impact our strategic goals. | ||||

|

Audit Committee The Audit Committee assists the Board in fulfilling its oversight responsibilities by monitoring the effectiveness of Antero’s systems of financial reporting, auditing and internal controls, as well as related legal and regulatory compliance matters. |

Nominating & Governance Committee The Nominating & Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure; succession planning for our directors and executive officers; and corporate governance. |

Compensation Committee The Compensation Committee assists the Board in fulfilling its oversight responsibilities by overseeing Antero’s compensation policies and practices. |

Environment, Sustainability and Social Governance (ESG) Committee The Environment, Sustainability and Social Governance (ESG) Committee provides guidance to the Board on matters related to corporate citizenship, environmental sustainability, and social and political trends, issues and concerns. |

Conflicts Committee The Conflicts Committee assists the Board in investigating, reviewing and evaluating potential conflicts of interest, including those between Antero and Antero Midstream. |

Board and Committee Self-Evaluations

The Board believes that a robust and constructive evaluation process is an essential component of Board effectiveness and good corporate governance. To that end, the Board and each of its standing committees conducts an annual self-assessment to evaluate their performance, composition, and effectiveness, and to identify areas for improvement.

These evaluations take the form of wide-ranging and candid discussions. The Lead Director facilitates discussions evaluating the full Board, and the committee chairs facilitate discussions regarding their respective committees. The Board and committee evaluations occasionally lead to changes in practices or procedures.

The Board held nine meetings in 2019. The then-serving outside directors held four executive sessions. No director attended fewer than 75% of the meetings of the Board and of the committees of the Board on which that director served during the respective period he or she served.

Pursuant to Antero’s Corporate Governance Guidelines, directors are encouraged to attend the Annual Meetings of Shareholders. All of the then-serving members of the Board attended the 2019 Annual Meeting.

|

- 2020 Proxy Statement | 20 |

Interested Party Communications

General Communications

Shareholders and other interested parties may communicate with us by writing to Antero Resources Corporation, 1615 Wynkoop Street, Denver, Colorado 80202. Shareholders may submit their thoughts to the Board, any committee of the Board, or individual directors on a confidential or anonymous basis by sending the communication in a sealed envelope marked “Shareholder Communication with Directors” and clearly identifying the intended recipient(s).

Antero’s Chief Administrative Officer will review and forward each communication, as expeditiously as reasonably practicable, to the addressee(s) if: (1) the communication complies with the requirements of any applicable policy adopted by the Board relating to the subject matter of the communication; and (2) the communication falls within the scope of matters generally considered by the Board. To the extent the subject matter of a communication is appropriate and relates to matters that have been delegated by the Board to a committee other than the addressee(s) or to an executive officer of Antero, the Chief Administrative Officer also may forward the communication to the executive officer or the chair of the applicable committee.

Legal or Compliance Concerns

Information regarding legal or compliance concerns may be submitted confidentially and anonymously, although Antero may be obligated by law to disclose the information or identity of the person providing the information in connection with government or private legal actions and in other circumstances.

Antero’s policy is not to take any adverse action, and not to tolerate any retaliation, against any person for asking questions or making good faith reports of possible violations of law, Antero’s policies or our Corporate Code of Business Conduct and Ethics.

Insider Trading Policy

Antero’s Insider Trading Policy, which applies to Antero’s employees, officers, and directors, prohibits hedging of Antero securities and engaging in any other transactions involving Antero-based derivative securities, regardless of whether the covered person is in possession of material, non-public information, except with regard to the vesting of securities acquired pursuant to Antero’s incentive, retirement, stock purchase, or dividend reinvestment plans, or other transactions involving purchases and sales of company securities between a covered person and Antero. Antero’s Insider Trading Policy also prohibits purchasing Antero common stock on margin (e.g., borrowing money to fund the stock purchase) and pledging Antero securities.

Available Governance Materials

The following materials are available on Antero’s website at www.anteroresources.com under “Investors” and then “Governance—Governance Documents.”

| • | Charter of the Audit Committee of the Board; | |

| • | Charter of the Compensation Committee of the Board; | |

| • | Charter of the Nominating & Governance Committee of the Board; | |

| • | Charter of the Environment, Sustainability and Social Governance (ESG) Committee of the Board; | |

| • | Corporate Code of Business Conduct and Ethics; | |

| • | Financial Code of Ethics; | |

| • | Corporate Governance Guidelines; and | |

| • | Whistleblower Policy. |

|

- 2020 Proxy Statement | 21 |

Shareholders may obtain a copy, free of charge, of any of these documents by sending a written request to Antero Resources Corporation, 1615 Wynkoop Street, Denver, Colorado, 80202. Any amendments to Antero’s Corporate Code of Business Conduct and Ethics will be posted in the “Governance” subsection of Antero’s website.

The Board had four standing committees in 2019: the Audit Committee, the Compensation Committee, the Nominating & Governance Committee and the Conflicts Committee. In April 2020, the Company established the Environment, Sustainability and Social Governance (ESG) Committee to, among other things, provide guidance to the Board on matters relating to corporate citizenship, environmental sustainability, and social and political trends, issues and concerns, as well as to advise the Board and management on significant public policy issues that are pertinent to the Company and its stakeholders. The charters of the Audit Committee, Compensation Committee, Nominating & Governance Committee and Environment, Sustainability and Social Governance (ESG) Committee are available on Antero’s website at www.anteroresources.com in the “Governance—Governance Documents” subsection of the “Investors” section.

The Board creates ad hoc committees on an as-needed basis. In 2018, Robert J. Clark, Benjamin A. Hardesty, and Joyce E. McConnell served on an ad hoc Special Committee formed by the Board to review certain potential related party transactions discussed below under the heading “Related Party Transactions—Agreements with Antero Midstream Corporation—Simplification Agreement.”

Current Members*: Paul J. Korus (chair), Benjamin A. Hardesty, Jacqueline C. Mutschler, Thomas B. Tyree, Jr.

Number of meetings in 2019: 6

The Audit Committee oversees, reviews, acts on, and reports on various auditing and accounting matters to the Board, including:

| • | the selection of Antero’s independent accountants, | |

| • | the scope of annual audits, | |

| • | fees to be paid to the independent accountants, | |

| • | the performance of Antero’s independent accountants, and | |

| • | Antero’s accounting practices. |

In addition, the Audit Committee oversees Antero’s compliance programs relating to certain legal and regulatory requirements.

Rules implemented by the NYSE and the Securities and Exchange Commission (“SEC”) require Antero to have an audit committee composed of at least three directors who meet particular independence and experience standards. The Board has determined that all members of the Audit Committee meet the heightened independence standards applicable to audit committee members. In addition, due to Mr. Korus’ substantial financial experience (based on his extensive background in technical accounting and auditing matters as the former Chief Financial Officer of Cimarex Energy), Antero believes Mr. Korus is an “audit committee financial expert” as defined in SEC rules.

| * | Richard W. Connor served as chair of the Audit Committee until January 24, 2019, at which point Mr. Korus became the chair. Robert J. Clark served on the Audit Committee until he was replaced by Mr. Tyree on October 7, 2019. |

|

- 2020 Proxy Statement | 22 |

Current Members*: Robert J. Clark (chair), Vicky Sutil, Thomas B. Tyree, Jr.

Number of meetings in 2019: 5

The Compensation Committee establishes salaries, incentives and other forms of compensation for our executive officers. The Compensation Committee also administers Antero’s incentive compensation and benefit plans, as well as reviews and recommends to the Board for approval the compensation of our non-employee directors.

Rules implemented by the NYSE require Antero to have a compensation committee composed of members who satisfy NYSE independence standards. All members of the Compensation Committee meet the NYSE’s independence standards, including the heightened requirements applicable to compensation committee members, and also meet the heightened independence requirements under SEC rules and the tax code. No Antero executive officer serves on the board of directors of a company that has an executive officer that serves on the Board.

| * | James R. Levy served on the Compensation Committee until June 12, 2019. Benjamin A. Hardesty and Joyce E. McConnell served on the Compensation Committee until they were replaced by Mr. Tyree and Ms. Sutil, respectively, on October 7, 2019. |

Nominating & Governance Committee

Current Members*: Benjamin A. Hardesty (chair), Robert J. Clark, W. Howard Keenan, Jr., Paul J. Korus, Vicky Sutil

Number of meetings in 2019: 4

The Nominating & Governance Committee identifies, evaluates and recommends qualified nominees to serve on the Board, develops and oversees Antero’s internal corporate governance processes, and directs all matters relating to the succession of Antero’s CEO.

Rules implemented by the NYSE require Antero to have a nominating & governance committee composed entirely of independent directors. All members of the Nominating & Governance Committee meet the NYSE’s independence standards.

| * | Richard W. Connor, Peter R. Kagan and Joyce E. McConnell served on the Nominating & Governance Committee until January 24, 2019, June 12, 2019 and March 1, 2020, respectively. |

Current Members*: Robert J. Clark (chair), Paul J. Korus, Jacqueline C. Mutschler, Thomas B. Tyree, Jr.

Number of meetings in 2019: 27

The Conflicts Committee assists the Board in investigating, reviewing and evaluating potential conflicts of interest, including those between Antero and Antero Midstream, as well as to carry out any other duties delegated by the Board that relate to potential conflict matters.

The Board established a Conflicts Committee as a standing committee of the Board in connection with the closing of the Transactions (as defined herein) in March 2019.

| * | Joyce E. McConnell served on the Conflicts Committee until she was replaced by Mr. Tyree on October 7, 2019. Benjamin A. Hardesty served on the Conflicts Committee through April 8, 2020. |

|

- 2020 Proxy Statement | 23 |

Environment, Sustainability and Social Governance (ESG) Committee

Current Members: Vicky Sutil (chair), Robert J. Clark, Benjamin A. Hardesty, Jacqueline C. Mutschler

Number of meetings in 2019:*

The Environment, Sustainability and Social Governance (ESG) Committee provides guidance to the Board on matters relating to corporate citizenship, environmental sustainability, and social and political trends, issues and concerns, as well as advises the Board and management on significant public policy issues that are pertinent to the Company and its stakeholders.

| * | The Board established an Environment, Sustainability and Social Governance (ESG) Committee as a standing committee of the Board in April 2020. |

Our non-employee directors are entitled to receive compensation consisting of retainers, fees and equity awards as described below. The Compensation Committee reviews non-employee director compensation on a periodic basis and recommends it to the Board for approval.

Our employee directors, Messrs. Rady and Warren, do not receive additional compensation for their services as directors. All compensation that Messrs. Rady and Warren received from Antero as employees is disclosed in the Summary Compensation Table.

Prior to their resignations, Messrs. Kagan and Levy transferred all or a portion of the compensation they received for their service as directors during 2019 to the shareholders with which they were affiliated.

The non-employee directors received the following compensation for their services during the 2019 fiscal year:

| Recipient | Amount | |||

| Non-employee director | $ | 70,000 | ||

| Lead Director | $ | 5,000 | ||

| Audit Committee: | ||||

| Chairperson | $ | 20,000 | ||

| Other members | $ | 7,500 | ||

| Compensation Committee: | ||||

| Chairperson | $ | 15,000 | ||

| Other members | $ | 5,000 | ||

| Nominating & Governance Committee: | ||||

| Chairperson | $ | 15,000 | ||

| Other members | $ | 5,000 | ||

| Conflicts Committee: | ||||

| Chairperson | $ | 5,000 | ||

| Other members | $ | 5,000 | ||

|

- 2020 Proxy Statement | 24 |

All retainers are paid in cash on a quarterly basis in arrears, but directors have the option to elect, on an annual basis, to receive all or a portion of their cash retainers in the form of shares of our common stock. For 2019, the directors did not receive any meeting fees, but each director is reimbursed for reasonable expenses incurred (i) to attend meetings and activities of the Board or its committees, and (ii) to facilitate participation in general education and orientation programs for directors.

Equity-Based Compensation and Stock Ownership Guidelines

In addition to cash compensation, our non-employee directors receive annual equity-based compensation consisting of fully-vested stock with an aggregate grant date value equal to $200,000, subject to the terms and conditions of the Antero Resources Corporation Long-Term Incentive Plan (“AR LTIP”) and the award agreements pursuant to which such awards are granted. These awards are granted on a quarterly basis such that each grant has a grant date value of approximately $50,000.

Under our stock ownership guidelines, each of our non-employee directors is required to own shares of our common stock with a fair market value equal to at least five times the amount of their annual cash retainer within five years of being appointed to the Board. These stock ownership guidelines are designed to align our directors’ interests more closely with those of our stockholders. All of the directors who are subject to this requirement and who have been on the Board for at least five years are in compliance with the ownership guidelines.

Responsiveness to Current Economic Environment

As a result of the unprecedented disruption the economy and our industry is currently facing and the market uncertainty and share price volatility since February of 2020, as of the filing of this Proxy Statement, the Board has deferred consideration of any potential changes to our director compensation program for 2020 until July 2020 and suspended the grant of our common stock to the non-employee members of the Board. For the time being, any non-employee director who had elected to receive his or her annual cash retainer in the form of shares of our common stock will instead receive those payments in cash. Quarterly equity awards will not be granted until further action is taken by the Board.

|

- 2020 Proxy Statement | 25 |

Total Non-Employee Director Compensation

The following table provides information concerning the compensation of our non-employee directors for the fiscal year ended December 31, 2019.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) | |||||||||

| Robert J. Clark(3)(4) | 152,500 | 200,000 | 352,500 | |||||||||

| Richard W. Connor(5) | 73,750 | 50,000 | 123,750 | |||||||||

| Benjamin A. Hardesty(4) | 156,250 | 200,000 | 356,250 | |||||||||

| Peter R. Kagan(3)(6) | 40,000 | 150,000 | 190,000 | |||||||||

| W. Howard Keenan, Jr. | 75,000 | 200,000 | 275,000 | |||||||||

| Paul J. Korus | 95,000 | 163,586 | 258,586 | |||||||||

| James R. Levy(3)(6) | 37,500 | 150,000 | 187,500 | |||||||||

| Joyce E. McConnell(7) | 133,750 | 200,000 | 333,750 | |||||||||

| Vicky Sutil(8) | 20,000 | – | 20,000 | |||||||||

| Thomas B. Tyree, Jr.(8) | 21,875 | – | 21,875 | |||||||||

| (1) | Includes annual cash retainer, committee fees and committee chair fees for each non-employee director during fiscal 2019, as more fully explained above. | |

| (2) | Amounts in this column reflect the aggregate grant date fair value of stock granted under the AR LTIP for service in fiscal year 2019, computed in accordance with the rules of Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718” ). See Note 9 to our consolidated financial statements on Form 10-K for the year ended December 31, 2019, for additional detail regarding assumptions underlying the value of these equity awards. The grant date fair value for stock awards is based on the closing price of our common stock on the grant date. Each of Messrs. Clark, Hardesty and Keenan hold 3,003 exercisable stock options. | |

| (3) | Mr. Clark elected to receive $25,625 of his retainer fees for the 2019 fiscal year in the form of common stock. Prior to their resignations, Messrs. Kagan and Levy elected to receive all of their retainer fees for the 2019 fiscal year in the form of common stock. | |

| (4) | Messrs. Clark and Hardesty and Ms. McConnell each received an additional cash retainer of $50,000 in connection with their service on the special committee created for purposes of evaluating and reviewing the Transactions. | |

| (5) | Mr. Connor resigned as a director on January 24, 2019. As a result of his resignation, the Company elected to pay Mr. Connor’s stock grant relating to the first quarter of fiscal year 2019 in cash in lieu of fully-vested common stock. | |

| (6) | Messrs. Kagan and Levy resigned as directors on June 12, 2019 in connection with the divestiture of Warburg Pincus’ remaining interests in Antero. | |

| (7) | Ms. McConnell resigned as a director on March 1, 2020 to focus her attention on serving as the President of Colorado State University. | |

| (8) | Ms. Sutil and Mr. Tyree were appointed as directors effective on October 7, 2019. |

|

- 2020 Proxy Statement | 26 |

| ITEM TWO: | RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee of the Board has selected KPMG LLP as Antero’s independent registered public accounting firm for the year ending December 31, 2020. KPMG LLP has audited Antero’s and its predecessor’s financial statements since 2003. The Audit Committee annually evaluates the accounting firm’s qualifications to continue to serve Antero. In evaluating the accounting firm, the Audit Committee considers the reputation of the firm and the local office, the industry experience of the engagement partner and the engagement team, and the experience of the engagement team with clients of similar size, scope and complexity as Antero. The Audit Committee is directly involved in the selection of the new engagement partner when rotation is required every five years in accordance with SEC rules. KPMG LLP completed the audit of Antero’s annual consolidated financial statements for the year ended December 31, 2019, on February 12, 2020.

The Board is submitting the selection of KPMG LLP for ratification at the Annual Meeting. The submission of this matter for ratification by shareholders is not legally required, but the Board and the Audit Committee believe the ratification proposal provides an opportunity for shareholders to communicate their views about an important aspect of corporate governance. If our shareholders do not ratify the selection of KPMG LLP, the Audit Committee will reconsider, but will not be required to rescind, the selection of that firm as Antero’s independent registered public accounting firm.

Representatives of KPMG LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement, and are expected to be available to respond to appropriate questions.

The Audit Committee has the authority and responsibility to retain, evaluate and replace Antero’s independent registered public accounting firm. Shareholder ratification of the appointment of KPMG LLP does not limit the authority of the Audit Committee to change Antero’s independent registered public accounting firm at any time.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE RATIFICATION OF THE SELECTION OF KPMG LLP AS ANTERO’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2020.

|

- 2020 Proxy Statement | 27 |

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Securities Exchange Act of 1934 , as amended (the “Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

Pursuant to its charter, the Audit Committee’s principal functions include the duty to: (i) oversee the accounting and financial reporting process of Antero and audits of Antero’s financial statements (ii) oversee the appointment, compensation, retention and oversight of the work of the independent auditors hired for the purpose of issuing an audit report or performing other audit, review or attest services for Antero; (iii) pre-approve audit or non-audit services proposed to be rendered by Antero’s independent registered public accounting firm; (iv) annually review the qualifications and independence of the independent registered public accounting firm’s engagement partner and other senior personnel who are providing services to Antero; (v) review with management and the independent registered public accounting firm Antero’s annual and quarterly financial statements, earnings press releases, and financial information and earnings guidance provided to analysts and ratings agencies; (vi) ratify certain related party transactions as set forth in Antero’s Related Persons Transactions Policy; (vii) review with management Antero’s major financial risk exposures; (viii) assist the Board in monitoring compliance with legal and regulatory requirements; (ix) prepare the report of the Audit Committee for inclusion in Antero’s proxy statement; and (x) annually review and reassess its performance and the adequacy of its charter.

While the Audit Committee has the responsibilities and powers set forth in its charter, and Antero’s management and the independent registered public accounting firm are accountable to the Audit Committee, it is not the duty of the Audit Committee to plan or conduct audits or to determine that Antero’s financial statements and disclosures are complete and accurate and in accordance with generally accepted accounting principles and applicable laws, rules and regulations.

In performing its oversight role, the Audit Committee has reviewed and discussed Antero’s audited financial statements with management and the independent registered public accounting firm.

The Audit Committee also has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable standards and regulations of the Public Company Accounting Oversight Board (the “PCAOB”). The Audit Committee has received the written disclosures and the written statement from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee also has considered whether the provision of non-audit services by the independent registered public accounting firm to Antero is compatible with maintaining the firm’s independence, and has discussed with the independent registered public accounting firm its independence.

Based on the reviews and discussions described in this Audit Committee Report, and subject to the limitations on the roles and responsibilities of the Audit Committee referred to herein and in its charter, the Audit Committee recommended to the Board that Antero’s audited financial statements for the year ended December 31, 2019, be included in the Form 10-K, which was filed with the SEC on February 12, 2020. As recommended by the NYSE’s corporate governance rules, the Audit Committee also considered whether, to ensure continuing auditor independence, it would be advisable to regularly rotate Antero’s independent registered public accounting firm. The Audit Committee has concluded that the current benefits to Antero from continued retention of KPMG LLP warrant retaining the accounting firm as Antero’s independent registered public accounting firm for the year ending December 31, 2020. The Audit Committee will continue to review this issue on an annual basis.

Members of the Audit Committee*:

Paul J. Korus (Chairman)

Benjamin A. Hardesty

Thomas B. Tyree, Jr.

| * | Includes all members of the Audit Committee as of the time the Audit Committee Report was approved for inclusion in this proxy statement. |

|

- 2020 Proxy Statement | 28 |

The table below sets forth the aggregate fees and expenses billed by KPMG LLP for the last two fiscal years to Antero (in thousands):

| For the Years Ended December 31 | ||||||||

| 2018 | 2019 | |||||||

| Audit Fees(1) | ||||||||

| Audit and Quarterly Reviews | $ | 2,095 | $ | 1,495 | ||||

| Other Filings | 153 | – | ||||||

| SUBTOTAL | 2,248 | 1,495 | ||||||

| Audit-Related Fees(2) | – | 100 | ||||||

| Tax Fees | – | – | ||||||

| All Other Fees | – | – | ||||||

| TOTAL | $ | 2,248 | $ | 1,595 | ||||

| (1) | Includes the audit of Antero’s annual consolidated financial statements included in the Annual Report on Form 10-K and internal controls over financial reporting and review of Antero’s quarterly financial statements included in Quarterly Reports on Form 10-Q. | |

| (2) | Represents fees related to other filings. |

The charter of the Audit Committee and its pre-approval policy require that the Audit Committee review and pre-approve the independent registered public accounting firm’s fees for audit, audit-related, tax and other services. The Chairman of the Audit Committee has the authority to grant pre-approvals up to a certain limit, provided such approvals are within the pre-approval policy and are ratified by the Audit Committee at a subsequent meeting. For the year ended December 31, 2019, the Audit Committee approved 100% of the services described above.

|

- 2020 Proxy Statement | 29 |

| ITEM THREE: | ADVISORY VOTE ON EXECUTIVE COMPENSATION |

Our policies are conceived with the intention of attracting and retaining highly qualified individuals capable of contributing to the creation of value for our shareholders. Our compensation program for 2019 was designed to be competitive with market practices and align the interests of our Named Executive Officers with those of Antero and its shareholders.

Shareholders are urged to read the Compensation Discussion and Analysis section of this Proxy Statement, which discusses how our compensation design and practices reflect our compensation philosophy for calendar year 2019. The Compensation Committee and the Board believe that our compensation practices for 2019 were effective in implementing our guiding principles.

Pursuant to Section 14A of the Exchange Act, we are submitting this annual proposal to our shareholders for an advisory vote to approve the compensation of our Named Executive Officers. This proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to express their views on the compensation of our Named Executive Officers for 2019. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers for 2019 and the principles, policies and practices described in this Proxy Statement. Accordingly, the following resolution is submitted for shareholder vote at the Annual Meeting:

“RESOLVED, that the shareholders of Antero Resources Corporation approve, on an advisory basis, the compensation of its named executive officers as disclosed in the proxy statement for the 2020 Annual Meeting pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and other related tables and disclosures.”

As this is an advisory vote, the result is not likely to affect previously granted compensation. The Compensation Committee will consider the outcome of the vote when evaluating our compensation practices going forward.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

|

- 2020 Proxy Statement | 30 |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides details on the following matters:

| • | Our 2019 say-on-pay advisory vote; |

| • | Our 2019 executive compensation program and the compensation awarded under that program; |

| • | Material actions taken with respect to our 2020 executive compensation program; and |

| • | Pertinent executive compensation policies. |

2019 NAMED EXECUTIVE OFFICERS

| Name | Principal Position |

| Paul M. Rady | Chairman of the Board and Chief Executive Officer |

| Glen C. Warren, Jr. | Director, President, Chief Financial Officer and Secretary |

| Alvyn A. Schopp | Chief Administrative Officer, Regional Senior Vice President and Treasurer |

| Michael N. Kennedy | Senior Vice President—Finance |

| W. Patrick Ash | Senior Vice President—Reserves, Planning and Midstream(1) |

| Kevin J. Kilstrom | Former Senior Vice President—Production(2) |

| (1) | Effective June 10, 2019, Mr. Ash was promoted from Vice President—Reservoir Engineering and Planning to Senior Vice President—Reserves, Planning and Midstream. |

| (2) | Effective August 16, 2019, Mr. Kilstrom retired as Senior Vice President—Production. |

At the Company’s 2019 annual meeting, the stockholders of the Company were asked to approve, on an advisory basis, the compensation of the Named Executive Officers. Advisory votes in favor of our executive compensation program were cast by over 97% of the shares of common stock of the Company counted as present and entitled to vote at the Company’s 2019 annual meeting. The Compensation Committee took the results of the “Say on Pay” vote in account when evaluating the compensation of the Named Executive Officers in 2019. We have continued, and plan to continue, seeking to engage in shareholder outreach regarding corporate governance generally, including executive compensation programs.

Compensation Philosophy and Objectives of Our Compensation Program

Since our inception, our compensation philosophy has been predominantly focused on recruiting individuals who are motivated to help us achieve superior performance and growth. Our company was founded by entrepreneurs whose strategy was to employ high-impact executives who are extremely effective at sparking superior performance with low overhead. These highly qualified and experienced individuals have contributed to the continued success of our Company, driving a 22% compound annual growth rate in debt-adjusted net production per share, which is one of the metrics for our annual incentive cash awards, since the Company’s 2013 IPO. As a result of our historical emphasis on long-term equity-based compensation, as of April 16, 2020, our Named Executive Officers hold approximately 9.7% of our outstanding shares, which ensures they identify with the best interests of our shareholders.

Recently, we have transitioned from an entrepreneurial-based management incentive structure to a more traditional compensation program. In 2018, this transition called for us to

|

- 2020 Proxy Statement | 31 |

make certain modifications to our compensation philosophy and attendant adjustments in our compensation program, which we have continued throughout 2019. More specifically, our goal is to focus on returns and value creation per share that will reward more disciplined capital investment, efficient operations, and free cash flow generation. In addition, for calendar year 2019, we utilized the simplified annual incentive program that focuses on four key performance metrics originally adopted in 2018. Further, for 2019, we targeted the market median for all elements of our Named Executive Officers’ compensation. We believe our compensation philosophy and practices promote a strong alignment between Named Executive Officer pay and Company performance, and deliver greater value to our shareholders as our Company continues to grow and mature.

The following table highlights the compensation best practices we followed during 2019 with respect to our Named Executive Officers during the time that they served as an executive officer:

| What We Do | |

|

Use a representative and relevant peer group |

|

Target the market median for all elements of Named Executive Officers’ compensation |

|

Apply robust minimum stock ownership guidelines |

|

Link annual incentive compensation to the achievement of objective pre-established performance goals tied to operational and strategic priorities |

|

Evaluate the risk of our compensation programs |

|

Use and review compensation tally sheets |

|

Provide 100% long-term incentive awards in the form of performance-based equity |

|

Use an independent compensation consultant |

|

Maintain a clawback policy |

| What We Don’t Do | |

|

No tax gross ups for executive officers |

|

No “single-trigger” change-in-control cash payments |

|

No excessive perquisites |

|

No severance arrangements for Named Executive Officers |

|

No guaranteed bonuses for Named Executive Officers |

|

No management contracts |

|

No re-pricing, backdating or underwater cash buy-outs of options or stock appreciation rights |

|

No hedging or pledging of Company stock |

|

No separate benefit plans for Named Executive Officers |

|

No granting of stock options with an exercise price less than the fair market value of the Company’s common stock on the date of grant |

Implementing Our Compensation Program Objectives

Role of the Compensation Committee

The Compensation Committee oversees all matters of our executive compensation program and has the final decision-making authority on all executive compensation matters. Each year, the Compensation Committee reviews, modifies (if necessary), and approves our peer group, corporate goals and objectives relevant to the compensation of the CEO and other Named Executive Officers, and the executive compensation program, including performance goals for the annual cash incentive program and long-term equity awards. In addition, the Compensation Committee is responsible for reviewing the performance of the CEO and the Company’s President, Chief Financial Officer and Secretary (“President/CFO”) within the framework of our executive compensation goals and objectives. Based on this evaluation, the Compensation Committee sets the compensation of the CEO and the President/CFO.

Actual compensation decisions for individual officers are the result of a subjective analysis of a number of factors, including the individual officer’s role within our organization, performance, experience, skills or tenure with us, changes to the individual’s position, and relevant trends in compensation practices.

|

- 2020 Proxy Statement | 32 |

The Compensation Committee also considers a Named Executive Officer’s current and prior aggregate compensation when setting future compensation. The Compensation Committee determines whether adjustments to compensation are necessary to adopt emerging best practices, reflect company performance, retain each executive or to provide additional or different performance incentives. Thus, the Compensation Committee’s decisions regarding compensation are the result of the exercise of judgment based on all reasonably available information.

Role of the Antero Midstream Compensation Committee and Allocation of Compensation Expenses