UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

ANTERO RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required |

|

Fee paid previously with preliminary materials |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Commencing on May 30, 2023, Antero Resources Corporation sent the following communication to certain stockholders.

Dear Stockholder,

We are writing to ask for your support for each of the proposals to be considered at our 2023 Annual Meeting of Stockholders to be held on June 6, 2023. In particular, we ask that you consider additional factors in evaluating our executive compensation program and vote FOR our Say on Pay proposal (Proposal 3).

Since our inception, Antero’s compensation philosophy has been predominantly focused on recruiting and retaining individuals who are motivated to help us achieve superior performance and growth. We seek to attract and retain exceptional talent by providing our executives with a competitive mix of fixed, time-based and performance-based compensation. Our performance-based compensation program focuses on motivating returns and value creation for our shareholders. We believe our compensation philosophy and practices for 2022 promoted a strong alignment between Named Executive Officer pay and Company performance, including a correction to a misalignment between pay and performance from the previous three-year period.

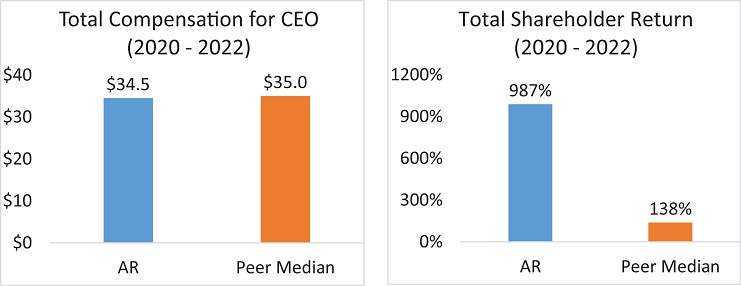

In addition to the 2022 compensation program providing incentives that promote performance, the 2022 compensation for our Named Executive Officers helped to correct a misalignment between pay and performance for 2020, 2021, and 2022. In October of 2022, Antero’s Compensation Committee, with assistance from its independent compensation consultant and management, reviewed (i) Antero’s total shareholder return for 2020 and 2021 and (ii) total compensation paid to Antero’s Chief Executive Officer for each of 2020, 2021 and 2022 (the last of which was based on projected cash compensation and April equity grants at the time of review by the committee). Antero’s Compensation Committee then compared those figures to the median of the same data points for the Company’s peer group included in the 2023 proxy statement (the “Peer Group”). As can be seen below, there was a concerning discrepancy between Antero’s exceptional performance and the below median compensation received by its Chief Executive Officer over the same period.

Peer Group median figures included in the above table were derived from total compensation figures reported in the summary compensation table for proxy statements filed in each of 2021, 2022 and 2023 reporting compensation in each of 2020, 2021 and 2022. Data reviewed by Antero’s Compensation Committee in October of 2022 included estimated values for 2022 compensation since that information was not available at the time. The total compensation for Antero’s CEO included in the table above does not include equity grants awarded in October of 2022 in order to illustrate the discrepancy in pay that motivated Antero’s Compensation Committee to grant special awards in October. The relationship between the compensation for our other Named Executive Officers and the other Named Executive Officers of the Peer Group is directionally the same as the

relationship between the compensation for our Chief Executive Officer and the Chief Executive Officers of the other members of the Peer Group.

After reviewing this data in October of 2022, the compensation committee granted additional long-term incentive awards to the Named Executive Officers as a correction of a misalignment between pay and performance (the “October Awards”). The Company reduced long term debt by nearly $2.6 billion from December 31, 2019 to December 31, 2022. This is a key factor affecting Company financial stability and Antero’s Compensation Committee considered this in their decision as well. Half of the October Awards were granted as restricted stock units, which will vest on the first three anniversaries of October 15, 2022. The other half of the October Awards were granted as performance share units, 50% of which vest based on absolute TSR and 50% of which vest based on the ratio of Net Debt to EBITDAX.

As illustrated below, after incorporating the October 2022 grant, the total target compensation for Antero’s Chief Executive Officer was still below the peer median over the three-year period, despite Antero substantially outperforming its peers over this time period.

As evidenced above, Antero believes that its 2022 Named Executive Officer compensation appropriately corrects a misalignment created by paying lower levels of compensation to our Named Executive Officers while substantially outperforming our Peer group over a three-year period and incentivizes management to continue to pursue outstanding performance and create value for all stockholders.

Ultimately, we believe that the compensation decisions made in 2022 achieve our goal of maintaining our pay-for-performance culture and positioning our compensation plans to support our business strategy over the long-term. We believe the Company’s financial performance reflects the effectiveness of our compensation program.

For the foregoing reasons, and for the reasons set forth in the 2023 Proxy Statement, we urge you to vote “FOR” the Say on Pay proposal (Proposal 3).

If you have any questions or would like to discuss the Say on Pay proposal with the Company, please do not hesitate to contact Michael Kennedy at (303) 357-7310. If you have any questions or need general assistance regarding voting, please contact our proxy solicitor, MacKenzie Partners, Inc., at (212) 929-5500 or proxy@mackenziepartners.com.