July 30, 2013

H. Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-3561

Re: Antero Resources Corporation

Registration Statement on Form S-1

Filed June 13, 2013

File No. 333-189284

Ladies and Gentlemen:

Set forth below are the responses of Antero Resources Corporation (the “Company,” “we,” “us” or “our”) to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated July 12, 2013, with respect to the Registration Statement on Form S-1, File No. 333-189284, filed with the Commission on June 13, 2013 (the “Registration Statement”).

Concurrently with the submission of this letter, we are filing through EDGAR Amendment No. 1 to the Registration Statement (“Amendment No. 1”). For your convenience, we will hand deliver three full copies of Amendment No. 1, as well as three copies of Amendment No. 1 that are marked to show all changes made since the initial filing of the Registration Statement.

For your convenience, each response is prefaced by the exact text of the Staff’s corresponding comment in bold, italicized text. All references to page numbers and captions correspond to Amendment No. 1 unless otherwise specified.

Registration Statement on Form S-1

General

1. Please consider the impact of the comments issued herein on the filings of Antero Resources LLC.

RESPONSE:

We acknowledge the Staff’s comment. To the extent that the Staff’s comments issued in respect of the Registration Statement impact disclosure in the filings of Antero Resources LLC, we expect to, beginning with the Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2013, make corresponding revisions therein.

2. Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering.

RESPONSE:

We acknowledge the Staff’s comment and will supplementally provide the Staff with (i) any written communications, as defined in Rule 405, that we will present to potential investors in reliance on Section 5(d) of the Securities Act of 1933, as amended (the “Securities Act”), with a future amendment to the Registration Statement and (ii) any research reports about us that are published or distributed in reliance on Section 2(a)(3) of the Securities Act added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating in the offering, in each case as such written communication or publication becomes available. To date, however, neither we nor the underwriters have engaged in any such communications or publications.

3. To the extent not cited, please provide copies of third-party reports or studies that support the qualitative and comparative statements contained in your prospectus or, in the alternative and as appropriate, please revise your disclosure to clarify whether they are management’s belief. As examples only, we note your statement in the second paragraph under “Prospectus Summary—Our Company” at page 1 relating to your management’s “proven” record and your statement at page 3 that you believe your “fully cycle drilling, completion and operating costs on a per unit basis are among the lowest in the Marcellus Shale and the industry as a whole.” Please mark your furnished support or provide page references in your response to the sections you rely upon for each specific statement. To the extent you are unable to provide support, please delete the qualitative and comparative statement.

RESPONSE:

We acknowledge the Staff’s comment and have attached as Annex A to this letter third-party reports or studies that support certain qualitative and comparative statements contained in the Registration Statement and have marked each report or study to highlight the applicable supporting information.

2

4. Please provide updates to the registration as appropriate. For example, we note that your descriptions of the registration rights agreement and credit support agreement appear to describe what you expect such agreements to establish, as opposed to what the agreements will establish.

RESPONSE:

We acknowledge the Staff’s comment and will undertake to update the descriptions in future amendments to the Registration Statement as such information becomes available, including disclosure as to what the registration rights agreement and credit support agreement will establish. In addition, we will include all information that we are not entitled to omit under Rule 430A in future amendments to the Registration Statement.

5. We note reference to a stockholders’ agreement in your exhibit index. Please provide a description of such agreement or tell us why you do not need to.

RESPONSE:

We acknowledge the Staff’s comment and have removed the reference to the Form of Stockholders’ Agreement in the exhibit list to the Registration Statement, as we no longer intend to enter into a stockholders’ agreement. Please see pages II-5 and II-11.

Prospectus Cover Page

6. Please revise the first paragraph to reference the secondary component of the proposed offering.

RESPONSE:

We acknowledge the Staff’s comment and have revised the first paragraph on the prospectus cover page to reference the secondary component of the offering.

Prospectus Summary, page 1

Our Company, page 1

7. You disclose the sum of the proved plus probable plus possible reserves on pages 1, 4, 53 and 78 and in the table on page 4. Please note the SEC Compliance and Disclosure Interpretations (C&DIs) issued October 26, 2009, clarifies the SEC’s position that it is not appropriate to sum up the individual deterministic estimates for these reserves into one total reserve estimate. Please revise your disclosure here and in all other locations in the prospectus where you sum up these reserves. Please refer to Question 105.01 in the SEC C&DI and revise the registration statement to exclude a total of your proved plus probable plus possible reserves.

RESPONSE:

We acknowledge the Staff’s comment and have revised Amendment No. 1 to remove the sum of our proved plus probable plus possible reserves in each place it appeared. Please see the inside cover of the prospectus and pages 1, 4, 53 and 78.

3

Our Properties, page 2

8. You disclose on page 2 and elsewhere on pages 3, 7, 78, 81 and 86 that you have drilled and completed horizontal wells in the Marcellus and Utica Shales with a 100% success rate. Please expand your disclosure to clarify the metrics you deem must be achieved to be 100% successful.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure to clarify the metrics we deem must be achieved for a 100% success rate. Please see page 2.

9. We note certain qualitative statements in your prospectus e.g. on page 2 that the Marcellus Shale has a “narrow and predictable band of expected well recoveries”, on page 86 that the Marcellus and Utica Shales are “characterized by consistent and predictable geology” and on page 7 that you have “substantially delineated and de-risked our large contiguous acreage position.” In light of number of wells drilled on your acreage to date as disclosed on page 96 and your statement on page 37 that “since new or emerging plays have limited or not production history, we are unable to use past drilling results in those areas to help predict our future drilling results,” please provide copies of internal or third-party reports or studies that support the qualitative statements contained in your prospectus. Please mark your furnished support or provide page references in your response to the sections you rely upon for each specific statement. As an alternative and as appropriate, please revise your disclosure to clarify whether they are management’s belief. To the extent you are unable to provide support, please delete the qualitative statement.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure where appropriate to note that certain qualitative statements are based on management’s beliefs. Please see pages 3, 8, 80 and 86. Additionally, we have attached as Annex B to this letter third-party and internal reports or studies that support certain other qualitative statements contained in the Registration Statement and have marked each report or study to highlight the applicable supporting information.

4

Reserves, page 3

10. We note your disclosure of eight different measures of PV-10 in the table presented on page 4 of your filing. We further note the reconciliation of the PV-10 measure calculated using SEC pricing and assuming ethane recovery along with the related surrounding disclosure on page 90. The relevance and usefulness of all eight PV-10 measures to an investor is currently unclear. Please tell us why the presentation of each PV-10 measure is appropriate and how this presentation provides useful, meaningful information to an investor. Your response should analyze the differences and similarities between all PV-10 measures as well as discuss the purposes for which management uses each measure. Alternatively, remove the PV-10 measures presented that are not calculated in a manner consistent with the standardized measure of discounted future net cash flows.

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit that the Registration Statement contains disclosure explaining our belief regarding the general utility to investors and management of the presentation of PV-10. Specifically, footnote 3 to the reserve table on page 4 of Amendment No. 1 provides in part:

We believe that the presentation of PV-10 is relevant and useful to our investors as supplemental disclosure to the standardized measure of future net cash flows, or after tax amount, because it presents the discounted future net cash flows attributable to our reserves prior to taking into account future corporate income taxes and our current tax structure. While the standardized measure is dependent on the unique tax situation of each company, PV-10 is based on a pricing methodology and discount factors that are consistent for all companies. Because of this, PV-10 can be used within the industry and by creditors and securities analysts to evaluate estimated net cash flows from proved reserves on a more comparable basis.

Though standardized measure of future net cash flows is only a GAAP measure prescribed with respect to proved reserves, we believe that PV-10 represents a useful analogue to the cash flows and value associated with various reserve quantities that can supplement or replace, as applicable, standardized measure of future net cash flows. Accordingly, we believe that our presentation of PV-10 for each of the reserve categories that we present in Amendment No. 1 under each of the relevant pricing scenarios is appropriate and may be useful to investors. Moreover, we believe that each combination of reserve category and pricing scenario that we present is sufficiently differentiated and useful for investors as follows:

· proved reserves, in addition to being required to be disclosed under Item 1202 of Regulation S-K, provide investors with an understanding of the reserves that we are most likely, and most presently able, to exploit (with the highest likelihood of meeting our economic assumptions);

· probable reserves and possible reserves provide investors with an understanding of the amount of production and reserve growth that we may expect to benefit from in the future, and we provided PV-10 for each category independently so that investors can understand the potential value imbedded in each reserve category, which carry different associated risk profiles;

· under SEC pricing at December 31, 2012, pricing conditions dictated ethane recovery as the more favorable economic assumption and, accordingly, our proved reserves (and the associated standardized measure of future net cash flows) required to be presented under Item 1202 of Regulation S-K were calculated on that basis;

· under the current pricing environment (with respect to SEC pricing and strip pricing), however, we believe that pricing conditions dictate ethane rejection as the more favorable economic assumption and, as a result, we believe that investors can derive a useful benefit from our disclosure of reserve volumes and the associated PV-10 values under the ethane rejection pricing sensitivity scenario; and

5

· as a complement to our disclosure of reserves under SEC pricing, assuming both ethane rejection and ethane recovery, we believe that investors benefit from our disclosure of each category of reserves using strip pricing as a sensitivity case, as we believe that it allows the volumetric and value-based measures to reflect a more forward-looking estimate of the applicable reserve values based on the currently anticipated commodity price environment.

Therefore, while we recognize that the volume of information that the combination of pricing scenarios, economic assumptions and reserve categories presented to investors is substantial, we believe that each specific combination provides additional granularity that can provide investors with a more complete understanding of our reserves and expected future cash flow sensitivities.

11. The disclosure of your probable and possible reserves appears to be limited to the total reserve quantity presented as a gas equivalent amount. Regulation S-K requires additional disclosure that includes a tabulation of the developed and undeveloped reserve quantities by individual product type in addition to the total reserves as presented. Please expand the tabular presentation on pages 4, 89 and 91 to incorporate the additional information required in Item 1202(a) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and have revised our tabular presentation to expand our disclosure of individual product types. For conciseness, we did not believe it was necessary to disclose the subcomponents of our reserve quantities in our summary presentation in “Prospectus Summary—Our Properties — Reserves.” We have revised the cross reference in the summary tabular presentation to refer an investor to the individual product types making up our developed and undeveloped reserve quantities currently disclosed in “Business” for full compliance with Item 1202(a) of Regulation S-K. Please see pages 5, 89, 90 and 92.

12. We note you disclose proved reserves here and elsewhere on pages 19, 89 and F-45 assuming ethane recovery. Please tell us if these estimates are reasonably certain and if so, why you supplementally provide estimates assuming ethane rejection in addition to estimates based on ethane recovery.

RESPONSE:

We acknowledge the Staff’s comment and confirm that our proved reserves assuming ethane recovery disclosed on the referenced pages are reasonably certain. We have provided proved reserves assuming both ethane recovery and ethane rejection in an attempt to provide investors with a fulsome picture of our reserves quantities in light of trends in the ethane pricing environment. As of December 31, 2012, the ethane price environment favored ethane recovery; however, since that time, the ethane market has shifted to one that we believe currently favors ethane rejection. As a result, our proved reserves as of June 30, 2013, which we have disclosed in Amendment No. 1, assume ethane rejection as a base case. As such, providing estimates of our proved reserves assuming each of ethane recovery and ethane rejection allows our investors to analyze our reserve quantities in light of market fluctuations and current pricing environments and our

6

historical results with our projected results and provides a basis for comparison between the dates.

13. The table on page 4 includes disclosure of the present value discounted at 10% (PV-10) using the NYMEX strip prices; however, this estimate of PV-10 using the NYMEX strip prices is not attributable to the reserve quantities presented in the table. Please revise the table to address disclosure of the reserves attributable to such analysis as required by Item 1202(b) of Regulation S-K and make it very clear that these represent a sensitivity analysis, not the actual PV-10 numbers or exclude the present value discounted at 10% (PV-10) using the NYMEX strip prices in this disclosure.

RESPONSE:

We acknowledge the Staff’s comment and have revised the tabular presentation to include the actual reserve quantities attributable to such analysis and have added additional language to clarify that such figures represent a sensitivity analysis. Please see pages 4 and 5.

14. Footnote (1) to the table on page 4 states the index prices disclosed for the Marcellus and Utica Shales were adjusted. Since the volumes and PV-10 presented are determined using the adjusted prices, please expand the disclosure here and elsewhere on pages 89 and 91 to provide the prices after the adjustments as noted.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure to provide a tabular presentation of the adjusted prices used in our reserve calculations for each of the Marcellus and Utica Shales for each reserve category under each pricing scenario. Please see pages 4, 5, 90, 91, 92, 94 and 95.

Operating Data, page 5

15. Please expand or revise the qualitative descriptions of the three types of potential Marcellus Shale locations here and elsewhere on page 82 to provide more specific quantitative descriptions relating to the disclosure in item (iii) on page 8 under Business Strengths which states you are targeting specific BTU windows.

RESPONSE:

We acknowledge the Staff’s comment and respectfully note that quantitative descriptions of each of “highly rich gas,” “rich gas” and “dry gas” are provided in the Glossary to the Registration Statement (the “Glossary”). For clarification, we have revised Amendment No. 1 to include a cross reference to such Glossary descriptions where the three types of potential Marcellus Shale locations are disclosed. Please see pages 6 and 82.

7

16. Please expand the disclosure in footnote (2) to explain the basis for determining the 1,250 “other” locations in the Upper Devonian Shale.

RESPONSE:

We acknowledge the Staff’s comment and note that in connection with Amendment No. 1, we have updated our reserve information as of June 30, 2013 and have filed the related reserve reports as exhibits to the Registration Statement. As anticipated, a portion of the 1,250 “other” locations in the Upper Devonian Shale are now included in either the proved, probable or possible reserve categories. Additionally, we have revised the disclosure to remove references to locations that are not attributable to proved, probable or possible reserves. Please see pages 6 and 82.

Midstream Infrastructure, page 6

17. You disclose on page 7 that you believe the installation of the 80-mile water pipeline system will reduce completion costs by up to $600,000 per horizontal well. Please tell us the extent to which this projected cost reduction has been incorporated into the calculation of the standardized measure of discounted future net cash flows relating to proved reserves as of December 31, 2012.

RESPONSE:

We acknowledge the Staff’s comment and submit that the projected cost reduction related to the water pipeline system was not incorporated into the calculation of the standardized measure of discounted future net cash flows relating to proved reserves as of December 31, 2012, as the project was not sufficiently certain to warrant adjustments in projected costs. In connection with Amendment No. 1, we have updated our reserve information as of June 30, 2013 and have filed the related reserve reports as exhibits to the Registration Statement. Our reserve estimates as of June 30, 2013 incorporate the projected cost reductions at the affected wells, and the associated increased capital costs for the installation of the water pipeline system, into the calculations of PV-10.

18. Here, or in the Glossary, briefly describe “cryogenic processing.”

RESPONSE:

We acknowledge the Staff’s comment and have added a definition of “cryogenic processing” to the Glossary. Please see page A-1.

Business Strengths, page 7

19. Please balance the disclosure contained in this section with the disclosure at page 28 under “Risk Factors—Risks Related to Our Business—Approximately 94% of our net leasehold acreage...,” as revised in response to our related comment herein.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure in “Business Strengths” to balance with the information in “Risk Factors—Risks Related to Our Business—Approximately 94% of our net leasehold acreage . . .” Please see pages 8 and 86.

8

Corporate Reorganization, page 11

20. Expand the chart to include the individuals controlling “Sponsors and Management” and Antero Resources Employee Holdings LLC.

RESPONSE:

We acknowledge the Staff’s comment and have revised the footnotes to the chart to include (or provide a cross reference to the identification of) the individuals controlling “Sponsors and Management” and Antero Resources Employee Holdings LLC. Please see pages 11 and 12.

Risk Factors, page 22

Currently, we receive significant incremental cash flows as a result of our hedging activity...page 26

21. Expand the first paragraph to indicate the percentage of production that were hedged and the percent of revenue attributable to hedges.

RESPONSE:

We acknowledge the Staff’s comment and have expanded our disclosure to include the percentage of production that was hedged and the percent of revenue attributable to hedges in each of the years ended December 31, 2011 and 2012. Please see pages 26 and 27.

Approximately 94% of our net leasehold acreage..., page 28

22. Please revise to quantify the amount of your leases that require you to drill wells that are commercially productive.

RESPONSE:

We acknowledge the Staff’s comment and have revised Amendment No. 1 to quantify the percentage of our leasehold acreage that requires us to drill wells that are commercially productive. Please see page 28.

Use of Proceeds, page 47

23. Please revise to provide the approximate amounts intended to be used for the repayment of your credit facility and for the funding of your capital expenditure program. See Item 504 of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and have revised Amendment No. 1 to include placeholders for the approximate amount of the net proceeds that will be used for repayment of our credit facility and for funding of our capital expenditure program. Please see pages 14 and 47.

9

Selected Historical Consolidated Financial Data, page 50

24. We note the non-GAAP measure EBITDAX includes an adjustment to remove unrealized gains and losses on commodity derivative contracts. Please tell us why this non-GAAP measure excludes the unrealized gains and losses, but includes the realized gains and losses on commodity derivative contracts.

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit that EBITDAX excludes unrealized gains and losses, but includes realized gains and losses, because the former represents a non-cash gain or loss and the latter represents a cash gain or loss. We believe that this is consistent with the intended purpose and utility of EBITDAX to illustrate our performance without giving effect to non-cash items. Moreover, we believe that this presentation is consistent with the presentation of comparable measures by similarly situated issuers, and it corresponds to the metric utilized by the lenders under our credit facility.

25. We note the disclosure of EBITDAX from discontinued operations as presented in the table on page 51 of your filing. Footnote (1) to the table provides a reconciliation of EBITDAX from continued operations. However, it does not appear that a reconciliation of EBITDAX from discontinued operations has been provided. Please expand your disclosure to reconcile EBITDAX from discontinued operations to the most comparable measure calculated in accordance with GAAP and provide all relevant disclosures required by Item 10(e) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and have revised our presentation to include a reconciliation of net income (loss) from discontinued operations to EBITDAX. Please see pages 18 and 52.

26. We note that the non-GAAP measure EBITDAX is used by your lenders pursuant to covenants under your credit facility and the indentures governing your senior notes. Please revise to show a reconciliation of this non-GAAP measure to cash flows from operating activities. Refer to Item 10(e)(1)(i)(A) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and have revised our presentation to include a reconciliation of EBITDAX to cash flows from operating activities. Please see pages 18 and 52.

10

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 53

Corporate Reorganization, page 55

27. We note that you intend to recognize stock compensation expense related to profits interest granted to your employees. Please tell us about the performance, market, and service conditions associated with these awards. Your response should explain your basis for deferring the recognition of compensation expense. In addition, please tell us whether former employees that hold profits interests will be able to exercise any vested awards upon the closing of your offering. Refer to FASB ASC 718-10-25.

RESPONSE:

We acknowledge the Staff’s comment and note that the profits interests represent membership interests that Antero Resources Employee Holdings LLC (“Employee Holdings”) holds in Antero Resources LLC (“Antero Resources”).

The performance, market and service conditions associated with these awards are contained in the Antero Resources operating agreement, which defines the amounts and conditions precedent to distributions to Employee Holdings with respect to its membership interests in Antero Resources. The Employee Holdings operating agreement contains similar provisions defining the amounts employees will be entitled to with respect to their membership interests in Employee Holdings.

Generally, the awards of interests in Employee Holdings vest over a 4-year period, but fully vest at the date of a liquidation or distribution event for current employees at that time. Employees whose employment is terminated prior to a liquidation or distribution event are entitled to (upon such an event) the lesser of the estimated fair value of their vested units at the date of their termination or the value of their vested units at the date of the liquidation or distribution event. There are no additional performance or market conditions that affect the employees’ rights to receive the value of their vested units at the date of the liquidation or distribution event.

The Antero Resources operating agreement provides for a distribution only in the case of a liquidation event, as defined by the agreement, in accordance with the waterfall provisions of the operating agreement. The waterfall provisions provide that the Investor class of unitholders receive the value of their initial investment plus a priority return of 8% per annum. The remaining value is distributed among the Investor class units and the incentive units on a variable basis, with the incentive units receiving a greater part of the distribution as the Investor class receives a greater return multiple on its investment.

Upon completion of this offering, Employee Holdings will exchange its interests in Antero Resources for similar interests in Antero Investment LLC (“Antero Investment”). The terms of these units will be substantially similar; however, the terms of the Antero Investment operating agreement will also provide for a liquidation event at a specified future date. At that future date, if a separate liquidation event has not occurred, a waterfall calculation will be made and Antero Investment will distribute the common stock of the Company that it holds to its owners, including Employee Holdings. Immediately, thereafter, the common stock held by Employee Holdings will be distributed to the employees. Any common shares distributed to employees in satisfaction of any unvested performance units will be subject to the same service condition.

As a result of the adoption of a provision for a specified future liquidation event, the likelihood of a liquidation event will become probable. Accordingly, we will recognize equity based compensation for all vested units as of the date of the adoption of the liquidation provision (upon completion of the offering) based on the fair value of the future distribution of the vested profit interests (estimated to be in the range of $200-$250 million). The fair value of the unvested common shares to be distributed (estimated to be in the range of $100-$150 million) will be amortized over the employees’ remaining service period until the distribution date in accordance with ASC 718-10-25-2. We plan to retain an independent valuation firm to estimate the fair value of the profit interests.

No current or former employees holding profits interests will receive any distributions with respect to their holdings in Employee Holdings upon the completion of this offering.

28. Please revise your disclosure regarding the compensation expense associated with your profits interests to indicate the amount that will be recognized upon the closing of your offering, the amount that will be deferred, and the period over which the deferred expense will be recognized.

RESPONSE:

We acknowledge the Staff’s comment and undertake to update our disclosure in a future amendment to the Registration Statement once such information is known. Since the compensation expense associated with our profit interests depends on the value of the ultimate offering, we cannot accurately provide such information at this time. However, after discussions with the underwriters in this offering, and by way of example only, based on our current expectations of value, the amount of compensation expense to be recognized upon the closing of the offering would be between $200 million to $250 million, with an additional $100 million to $150 million to be amortized over the two years following the closing of the offering. We have revised our disclosure in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Corporate Reorganization” to provide placeholders for these amounts. Please see page 55.

Business, page 78

Price Sensitivity, page 90

29. Revise the current presentation to make it clear that these tables do not represent your actual reserves under Rule 4-10 of Regulation S-K. Your tables use the same headings as those on page 89. We direct you to the heading used in the sample table in Item 1202 (9)(b) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and have revised the tabular headings to clarify that these tables do not represent our actual reserves under Rule 4-10 of Regulation S-K. Please see pages 91 and 92.

11

30. Please amend the disclosure relating to the use of “strip” pricing to provide an explanation of the source and basis of the prices and the extent to which the strip prices used increase, decrease or remain constant over the producing life of the properties as required by Item 1202(b)(3) of Regulation S-K. Furthermore, please advise or amend the disclosure to clarify that the sensitivity analysis is limited to changes in prices and does not include changes to costs or the number of locations evaluated.

RESPONSE:

We acknowledge the Staff’s comment and have amended our disclosure relating to the use of “strip” pricing to provide an explanation of the source and basis of the prices and the extent to which the strip prices used increased over the producing life of the properties as required by Item 1202(b)(3) of Regulation S-K. Please see page 91. The sensitivity analysis is limited to changes in prices and does not include changes to costs or the number of locations evaluated.

Proved Undeveloped Reserves, page 92

31. Please expand the disclosure presenting the tabulation of 2012 changes in proved undeveloped reserves to incorporate a reconciliation of the 377 Bcfe converted from proved undeveloped to developed.

RESPONSE:

We acknowledge the Staff’s comment and have revised the tabular presentation in proved undeveloped reserves to incorporate a reconciliation of the 377 Bcfe converted from proved undeveloped to developed. Please see page 96.

32. You state that all of your proved undeveloped reserves are expected to be developed over the next five years. For purposes of determining the five year period, Item 1203(d) of Regulation S-K identifies the initial disclosure and date thereof as the starting reference date. Please tell us if any of your proved undeveloped volumes disclosed as of December 31, 2012 will take more than five years since initial disclosure to develop.

RESPONSE:

We acknowledge the Staff’s comment and respectfully note that none of our proved undeveloped volumes disclosed as of December 31, 2012 will take more than five years from initial disclosure to develop.

12

Preparation of Reserve Estimates, page 93

33. We note your reference to “generally accepted petroleum engineering and evaluation principles. While we understand that there are fundamentals of physics, mathematics and economics that are applied in the estimation of reserves, we are not aware of an official industry compilation of such “generally accepted petroleum engineering and evaluation principles”. With a view toward possible disclosure, please explain to us the basis for concluding that such principles have been sufficiently established so as to judge that the reserve information has been prepared in conformity with such principles. Refer us to a compilation of these principles.

RESPONSE:

We acknowledge the Staff’s comment and note that we use the deterministic and probabilistic evaluation methodology discussed in the Society of Petroleum Evaluation Engineers (the “SPEE”) Monograph 3, “Guidelines for the Practical Evaluation of Undeveloped Reserves in Resources Plays” (the “SPEE Monograph 3”), and Society of Petroleum Engineers Petroleum Resources Management System and consider such to be “generally accepted petroleum engineering and evaluation principles.” We have revised our disclosure to clarify that such guidelines and principles were established by the SPEE. Please see page 96.

Methodology Used to Apply Reserve Definitions, page 94

34. We note your description of the methodology used to attribute proved undeveloped locations in the Marcellus Shale. Please refer to Rule 4-10(a)(31) and provide us with an expanded narrative of the methodology including the evidence for the use of reliable technology that establishes reasonable certainty of economic producibility at greater distances than a direct offset. Please include a schematic diagram as part of your explanation to illustrate the physical arrangement and orientation resulting in up to 11 proved undeveloped locations offsetting a proved producing well. Please tell us the supporting technical data for booking probable locations within a three-mile radius of existing Marcellus Shale production. Also tell us the constraints, if any, applied to the lateral distance from existing Marcellus Shale production for booking possible locations.

RESPONSE:

We acknowledge the Staff’s response and offer the following expanded narrative. From the time of initial drilling in 2009 through December 31, 2012, we drilled 118 horizontal wells in the Marcellus Shale over a 578-square mile area in West Virginia with a 100% success rate, all of which were completed and produce in commercially viable quantities. Additionally, we have access to geologic data from a large number of Antero-operated vertical wells and non-operated vertical and horizontal wells across our acreage block in the Marcellus Shale, including well logs and production data.

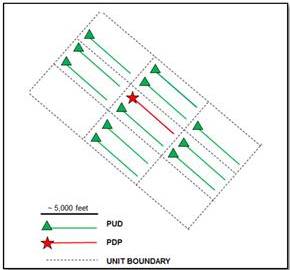

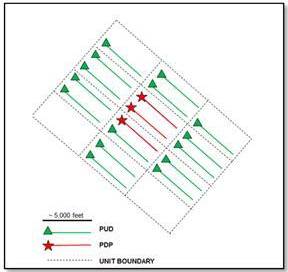

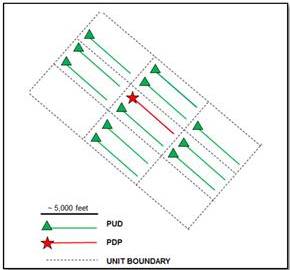

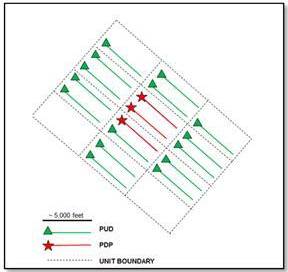

We book proved undeveloped reserves in offset “units” when we have sufficient land, geologic and production data to support the “reasonable certainty” standard. In our reserves methodology discussion, we state that “. . . we may attribute up to 11 proved undeveloped locations based on one proved developed producing well.” This 11:1 ratio represents an idealized example. Figure (1) below illustrates the maximum 11 locations that could be booked in offsetting units. Figure (2) below represents the more standard methodology in use for a three-well PDP “pack,” a more frequent situation given our strategy to drill multiple wells on a single pad whenever possible. This methodology results in a 5:1 PUD-PDP ratio in the given example.

13

In either case, achieving the maximum ratio is predicated on the geologic and engineering analysis of the area.

|

Figure (1) |

|

Figure (2) |

|

|

|

|

|

|

|

We believe that the homogenous nature of the shale formation we have encountered to date extends over our acreage position in the Marcellus Shale. Accordingly, we do not believe there are any constraints on the lateral distance with regards to booking possible locations on our acreage in the Marcellus Shale.

35. We also note your description of the methodology used to attribute proved undeveloped locations in the Utica Shale. Please provide us with an expanded narrative of the methodology explaining why the offsetting proved undeveloped locations are reasonably certain. Please include a schematic diagram as part of your explanation to illustrate the physical arrangement and orientation resulting in only 4 proved undeveloped locations offsetting a proved producing well. Also provide us with a narrative to explain the methodology for booking your probable and possible Utica Shale locations.

RESPONSE:

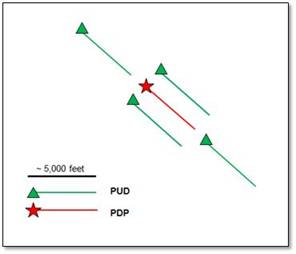

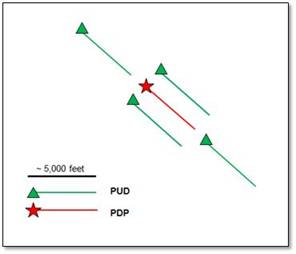

As of June 30, 2013, 309 horizontal wells had been drilled industry-wide in the Utica Shale, 30 rigs were running in the Ohio portion of the Utica Shale, and another 812 horizontal wells had been permitted by the State of Ohio. Production was submitted to the State of Ohio for 85 wells in the Utica Shale in 2012.

As of June 30, 2013, we had two rigs drilling in the Utica Shale and had tested 11 key wells in the area that delineated our acreage block from east to west. Data from our Utica Shale wells, along with data from additional non-operated Utica Shale wells, was sufficient to define geologic boundaries and the reservoir fluid type from east and west across the play. We booked proved undeveloped reserves in direct offset locations where we had sufficient land, geologic

14

and production data to support the “reasonable certainty” standard. Figure (1) below illustrates the maximum four locations that could be booked in offsetting units.

Figure (1)

Our proved reserves in the Utica Shale are booked pursuant to the same methodology used in the Marcellus Shale with the exception that each proved developed producing well is only able to generate four direct offset well locations (as opposed to five locations in the Marcellus Shale) due to less relative maturity. Our probable and possible reserves in the Utica Shale are booked pursuant to the same methodology used in the Marcellus Shale. In the case of each of our reserve categories in the Utica Shale, we have not established a highly developed area as we have in the Marcellus Shale, again due to our relatively limited operating history in the area.

Major Customers, page 98

36. Please identify, and file the agreements you have with, your top three customers for 2012 or tell us why you do not need to. See Items 101(c)(1)(vii) and 601(b)(10) of Regulation S-K. While we note your statement that you do not believe the loss of such customers would have a material adverse effect on your business, please clarify your belief in light of your disclosure of the percentage of your total sales such customers accounted for.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure to include the names of our top three customers for 2012. Please see page 101. We respectfully submit that each of the agreements entered into with our top three customers for 2012 are immaterial to our operations for the reason that we do not believe that the loss of any such customer would have a material adverse effect on our business and thus need not be filed pursuant to Item 601(b)(10). Item 601(b)(10) requires the filing of a contract if it is material and not made in the ordinary

15

course of business. Each agreement entered into with the listed customers was made in the ordinary course of our business. Additionally, each of the agreements are immaterial to our operations, as we do business with many customers, including the three specified here, and each customer could be readily replaced with minimal service interruptions should the need arise. The region in which we operate is characterized by both an adequate supply of operating customers and sufficient operational logistics to replace customers as necessary.

Further, we do not believe that the information contained in such agreements is material to an investor’s investment decision. The agreements representing 23% and 13% of our total sales, respectively, are each based on sales delivery commitments for multiple years, and we anticipate that such contracts will represent much lower percentages of our total sales for the remaining lives of the contracts, including 2013. Additionally, we are currently in the process of phasing out the customer representing 10% of our total sales in 2012, and thus will continue to be immaterial to our total sales in future periods.

Legal Proceedings, page 108

37. Please revise to include the name of the courts in which the proceedings in Colorado, West Virginia and Pennsylvania are pending, the date instituted and the principal parties thereto. See Item 103 of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit our belief that the proceedings in Colorado, West Virginia and Pennsylvania are not material litigation required to be disclosed pursuant to Item 103 of Regulation S-K. As such, we have revised the legal proceedings disclosure to remove reference to such pending litigation. Please see page 111.

Management, page 109

Directors and Executive Officers, page 109

38. Please revise to provide a start date for Mr. Manning’s employment at Trilantic Capital Partners.

RESPONSE:

We acknowledge the Staff’s comment and have revised Mr. Manning’s biography to include his start date at Trilantic Capital Partners. Please see page 112.

16

Committees of the Board of Directors, page 112

39. Please revise to identify the member(s) of your board that will be on its audit committee.

RESPONSE:

We acknowledge the Staff’s comment and undertake to disclose the members of our board of directors that will serve on our audit committee in a future amendment to the Registration Statement once such individuals have been identified.

Certain Relationships and Related Party Transactions, page 116

General

40. Please file the contribution agreement that you will enter into in connection with contributing your midstream business to Antero Midstream. See Item 601(b)(10) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and will file in a future amendment to the Registration Statement a form of the contribution agreement that we will enter into in connection with the contribution of our midstream assets to Antero Resources Midstream LLC (“Antero Midstream”). We have updated the Registration Statement to note that such contribution will occur pursuant to a contribution agreement and have additionally updated the exhibit list to the Registration Statement to note that such contribution agreement will be filed by amendment. Please see pages 119, II-5 and II-11.

41. Please file the agreements you have with Crosstex’s affiliates or tell us why you do not need to.

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit that we do not believe that the agreements with the affiliate of Crosstex are material to us or an investor’s decision to invest in us. The sole reason the related party disclosure arises is because one of the principals of Yorktown Partners LLC is also a director of Crosstex, and neither such individual nor Yorktown derives any direct pecuniary interest from Crosstex’s business generally or the disclosed agreements specifically. In addition, the Yorktown principal does not have a financial stake in such agreements. Pursuant to Instruction 6 to Item 404(a) of Regulation S-K, the Yorktown principal is not deemed to have an indirect material interest in the relationship, as the interest arises only through his position as a director of Crosstex. We provided the related party disclosure solely for purposes of full transparency to our investors. As a result, we do not believe that such agreements are required to be filed as exhibits to the Registration Statement pursuant to Item 404 or Item 601 of Regulation S-K.

17

Antero Midstream, page 116

42. We note your discussion of the contribution of the midstream business to Antero Resources Midstream, LLC and the issuance of a special membership interest to Antero Resources Midstream Management LLC in connection with the offering. Please provide us with your analysis of the ownership and control of Antero Resources Midstream, LLC under FASB ASC 810-10-25. In your response, please provide sufficient detail supporting the identification of the primary beneficiary that will consolidate Antero Resources Midstream, LLC after the corporate reorganization.

RESPONSE:

We acknowledge the Staff’s comment and note that, based on the provisions of FASB 810-10-15, we plan to consolidate the accounts of Antero Midstream with Antero Resources Corporation. Antero Resources Corporation will initially own 100% of the economic interests in Antero Midstream and provide 100% of its required financing. Antero Resources Corporation will direct the activities of Antero Midstream that most significantly impact Antero Midstream’s financial performance, will absorb Antero Midstream’s potential losses, and will receive the expected residual returns of Antero Midstream through its 100% ownership of economic interests. Antero Resources Midstream Management LLC (“Midstream Management”) will not have any management or economic rights other than the right to cause at some time in the future an initial public offering of Antero Midstream through a master limited partnership or similar structure and certain consent rights.

Based on these facts, we believe that prior to any initial public offering of Antero Midstream, Antero Resources Corporation will be the primary beneficiary of the activities of Antero Midstream, as substantially all of Antero Midstream’s activities will either involve or will be conducted on behalf of Antero Resources Corporation. Accordingly, the activities of Antero Midstream will be consolidated into Antero Resources Corporation.

Corporate Reorganization, page 122

43. We note that Antero Investment’s limited liability company agreement provides that Antero Investment and its members will agree to vote the shares of your common stock held by Antero Investment in favor of the election of certain directors to your board. Please file the agreement. See Item 601(b)(10) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and respectfully submit our belief that the limited liability company agreement of Antero Investment does not constitute a material contract pursuant to Item 601(b)(10) of Regulation S-K and thus is not required to be filed as an exhibit to the Registration Statement. Specifically, we note that the limited liability company agreement is not a contract “to which the registrant or subsidiary of the registrant is a party or has succeeded to a party by assumption or assignment. . . .”

In addition, we note that the limited liability company agreement does not establish or define the agreement or rights to vote among unrelated parties, but rather it defines how the interests held by Antero Investment will be voted. We believe that the only aspects of the limited liability company agreement that may be relevant to investors in our common stock are already disclosed in the Registration Statement. Please see pages 120, 125 and 126. In addition, we anticipate that any voting agreement amongst shareholders will be filed under Schedule 13D to the extent required by the Securities and Exchange Act of 1934, as amended. Accordingly, we respectfully request that the Staff reconsider its position that the limited liability company

18

agreement of Antero Investment is required to be filed as an exhibit to the Registration Statement.

Principle and Selling Stockholders, page 124

44. Indicate the beneficial owner - person(s) having voting or investment power — for Antero Resources. That would include those individuals having such power for Yorktown Energy Partners and Trilantic Capital Partners.

RESPONSE:

We acknowledge the Staff’s comment and have revised Amendment No. 1 to disclose the individuals having voting or investment power for Yorktown Energy Partners and Trilantic Capital Partners. Please see pages 128 and 129.

Underwriting (Conflicts of Interest), page 136

45. To the extent such arrangements are not provided for in the underwriting agreement, please file the lock-up agreements.

RESPONSE:

We acknowledge the Staff’s comment and note that the lock-up agreements will be filed as exhibits to the underwriting agreement, which we will file as an exhibit to a future amendment to the Registration Statement.

Financial Statements, page F-1

46. Please expand your disclosures to explain why you have presented the financial statements of Antero Resources LLC for the registrant, Antero Resources Corporation. Your disclosure should address any expected differences between the entities after the corporate reorganization, such as, but not limited to, the change in equity structure.

RESPONSE:

We acknowledge the Staff’s comment and respectfully note that the financial statements of Antero Resources LLC and Antero Resources Corporation are, and will continue to be after the corporate reorganization, identical with respect to the underlying financial information. Additionally, in connection with the closing of the offering, Antero Resources LLC will merge with and into us, at which time Antero Resources LLC’s financial statements will become (and remain identical to) our financial statements in whole.

19

47. We remind you of the requirements to update your financial statements and related disclosure throughout the filing to comply with the requirements of Rule 3-12 of Regulation S-X.

RESPONSE:

We acknowledge the Staff’s comment and will undertake to update our financial statements and related disclosure throughout the Registration Statement in future amendments as required by Rule 3-12 of Regulation S-X.

Consolidated Balance Sheets, page F-19

48. We note that you have included a line item captioned “producing properties” on the face of your consolidated balance sheets. However, it does not appear that all of your proved properties are producing properties. Please revise to provide a more appropriate caption. This comment also applies to the disclosure of capitalized costs provided on page F-43 of your filing.

RESPONSE:

We acknowledge the Staff’s comment and have revised the line item captioned “producing properties” to be “proved properties” in each of the noted locations to clarify that not all of our proved properties are producing properties. Please see pages F-20 and F-45.

49. We note that you have presented discontinued operations information related to the sale of your Arkoma and Piceance Basin properties during 2012. However, it does not appear that you have disclosed the major classes of assets and liabilities of the disposal group for periods prior to the date of sale. Please tell us how you considered the guidance per FASB ASC 205-20-50-2.

RESPONSE:

We acknowledge the Staff’s comment and submit that FASB ASC 205-20-50-2 requires that the major classes of assets and liabilities held for sale be separately disclosed on the face of the statement of financial position or in the notes to the financial statements. FASB ASC 360-10-45-9 provides that long-lived assets be classified as held for sale in the period in which all of six specified criteria are met. One of the criteria (360-10-45-9 d.) is “…the sale of the asset (disposal group) is probable, and transfer of the asset (disposal group) is expected to qualify for recognition as a completed sale, within one year….” Because of the depressed market for natural gas properties in Oklahoma and Colorado at the time we began pursuing the sale of these properties, we did not believe that it probable that we would receive a bona fide offer at a mutually acceptable sales price within a year of the date of any financial statements issued. Since we did not meet all of the required criteria to classify the assets as held for sale, they were not reclassified in the financial statements.

20

Consolidated Statements of Operations and Comprehensive Income (Loss), page F-20

50. We note that Antero Resources LLC is not subject to federal or state income taxes. We note further that investors will hold shares of common stock in Antero Resources Corporation, a Delaware corporation, when the corporate reorganization is completed. Please revise to disclose pro forma tax and earnings per share information on the face of your historical statements of operations for each period presented. This disclosure should give effect to planned equity transactions such as the conversion of members’ equity into shares of common stock.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure to include pro forma earnings per share information on the face of our historical financial statements for each period presented. We have not included pro forma tax information, however, as no changes will be made to our tax obligations in connection with the reorganization as noted in the “Introductory Note to Financial Statements.” Please see pages F-1, F-3 and F-21.

Notes to Consolidated Financial Statements

(7) Long-term Debt, page F-32

51. We note your senior notes issuances include change of control provisions that may require Antero Resources Finance Corporation to repurchase the notes prior to maturity. Please tell us whether the offering and corporate reorganization of Antero Resources LLC and Antero Resources Corporation constitutes a change of control that would trigger this provision.

RESPONSE:

We acknowledge the Staff’s comment and respectfully confirm that the offering and corporate reorganization of Antero Resources LLC and Antero Resources Corporation does not constitute a change of control under the indentures governing our senior notes.

52. Please provide us with your analysis to support why separate, full financial statements of your guarantor subsidiaries are not required to be presented in accordance with Rule 3-10 of Regulation S-X. If you believe your senior notes meet the criteria for relief from providing full financial statement disclosure, please revise your current footnote to provide full and complete disclosure as required.

RESPONSE:

We acknowledge the Staff’s comment and have revised our current financial statement footnote to include the information required by Rule 3-10 of Regulation S-X. Because we meet the requirements of Note 5 to Rule 3-10(d), we have not included the condensed consolidating footnote that would otherwise be required and have instead disclosed the information required by Note 5. Please see pages F-8, F-9, F-30 and F-31. Additionally, we will provide similar information in Antero Resources LLC’s periodic reports in the future, beginning with the Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2013.

21

(9) Ownership Structure, page F-35

53. Please tell us whether you expect to make distributions to your class units and class profit units as a result of the offering. If so, please expand your disclosures throughout the filing, including the use of proceeds section, to discuss the expected distribution amounts and source of funding.

RESPONSE:

We acknowledge the Staff’s comment and confirm that we do not expect to make distributions to our class units and class profit units as a result of this offering.

(16) Supplemental Information on Oil and Gas Producing Activities, page F-43

Costs Incurred in Certain Oil and Gas Activities, page F-43

54. Please revise to provide disclosure consistent with the categories of costs described by FASB ASC 932-235-50-18 (i.e., acquisition costs, exploration costs, and development costs). Also, refer to FASB ASC 932-235-55-4.

RESPONSE:

We acknowledge the Staff’s comment and have revised the tabular presentation to include the categories of costs described by FASB ASC 932-235-50-18. Please see page F-45.

Oil and Gas Reserves, page F-44

55. Please reconcile the statement on page F-44 that the Company estimates proved reserves using average pricing for the previous 12 months with the statement on page F-46 that future cash inflows were computed by applying historical 12-month unweighted first day of the month average prices.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure to make clear that, in both instances, the historical 12-month unweighted first day of the month average prices were used. Please see page F-46.

56. Please refer to the requirements set forth in FASB ASC paragraph 932-235-50-5 and revise the disclosure relating to the 2010 and 2011 revisions to provide an explanation for the changes consistent with the disclosure provided for 2012. Also, please tell us how you have considered changes resulting from the realization and execution of gas processing agreements for inclusion as extensions and discoveries.

RESPONSE:

We acknowledge the Staff’s comment and have revised our disclosure as it relates to the 2010 and 2011 to provide an explanation for the changes consistent with the disclosure provided for 2012. Please see page F-48. The effect of the execution of gas processing agreements allowed us to consider processed natural gas liquids in our future revenue streams from reserves. The resulting increase in equivalent reserves was included in extensions and discoveries in the year-to-year reconciliation of our reserve quantities.

22

57. Please tell us if abandonment costs have been included as part of the future development costs used to calculate the standardized measure relating to your proved oil and gas reserve quantities. Refer to the guidance provided by the Division of Corporation Finance at http://www.sec.gov/divisions/corpfin/guidance/oilgasletter.htm.

RESPONSE:

We acknowledge the Staff’s comment and note that abandonment costs have been included as part of the future development costs used to calculate the standardized measure relating to our proved oil and gas reserve quantities.

Exhibit 99.1, Exhibit 99.2, Exhibit 99.3, Exhibit 99.4, Exhibit 99.5, Exhibit 99.6

General

58. Based on our calculations, the condensate and NGL yields appear to vary significantly when comparing the estimates for proved, the estimates for probable and the estimates for possible using information disclosed in the reserve reports for the Marcellus and Upper Devonian Shales and the Utica Shale. We have conducted the same comparison for the estimates attributable to the ethane rejection sensitivity analysis and also note significant variances in the liquids yields according to reserve category. Please provide us with a narrative and supporting data explaining the methodology used to estimate the amounts of condensate and NGLs assigned for each reserve category. As part of this narrative, please provide an explanation for the apparent variance according to reserve category.

RESPONSE:

We acknowledge the Staff’s comment and provide the following explanation.

NGL yields vary directly with natural gas Btu, with increasing yield at higher Btu. The Marcellus Shale is characterized by increasing gas Btu from east to west, and our Marcellus Shale development has similarly progressed from east to west. Our NGL yields thus vary by reserve category, as our proved reserves tend to be in the eastern portion of our Marcellus Shale acreage (characterized by lower Btu) and our probable reserves tend to be in the western portion of our Marcellus Shale acreage (characterized by higher Btu). Because it has been historically uneconomic to produce NGLs in the dry portions of the shale formation, our reserve categories have varied as our Marcellus Shale acreage has progressed into liquids-rich portions. As of December 31, 2012, condensate production was only associated with Marcellus Shale gas production that was generally greater than 1250 Btu.

23

Methodology and Procedures

59. Please advise or amend the reports to acknowledge the third party’s concurrence with the methodology disclosed on page 94 of the Registration Statement as part of the disclosures under Item 1202(a)(8)(iv) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment. Our independent reserve engineers, DeGolyer and MacNaughton (“D&M”), were involved in the development of the disclosed methodology alongside our internal reserve engineers and have amended each of the reserve reports to acknowledge concurrence as requested by the Staff. Please see Exhibits 99.1—99.6.

Primary Economic Assumptions

60. Please amend the third party reports to include the pricing hub used as the basis for the reference prices as part of the disclosure of the primary economic assumptions under Item 1202(a)(8)(v) of Regulations S-K.

RESPONSE:

We acknowledge the Staff’s comment and note that the pricing hub used as the basis for the reference prices is the Columbia Gas Transmission Appalachia index. D&M has amended each of the reserve reports to include such information in the disclosure of the primary economic assumptions. Please see “Primary Economic Assumptions” in each of Exhibits 99.1—99.6.

Operating Expenses and Capital Costs

61. Please advise or amend the third party reports to indicate whether abandonment costs were considered as part of the disclosure of assumptions under Items 1202(a)(8)(iv) and 1202(a)(8)(v) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and note that D&M has amended each of the reserve reports to disclose that abandonment costs were considered as a portion of “Operating Expenses and Capital Costs.” Please see “Primary Economic Assumptions” in each of Exhibits 99.1—99.6.

Ethane Rejection Sensitivity Case

62. Please amend the third party reports to include an explanation of the purpose, relevance and basis for presenting an ethane rejection sensitivity case as part of the disclosures under Item 1202(a)(8)(i) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment. D&M has amended each of the reserve reports as requested by the Staff. Please see Exhibits 99.1—99.6.

24

63. Please advise or amend the third party reports to clarify the sensitivity analysis does not include changes to costs or the number of locations evaluated as compared to the estimates based on ethane recovery as part of the disclosures under Item 1202(a)(8)(v) of Regulation S-K.

RESPONSE:

We acknowledge the Staff’s comment and note that D&M has amended each of the reserve reports to clarify that the sensitivity analysis does not include changes to costs or the number of locations evaluated as compared to the estimates based on ethane recovery. Please see Exhibits 99.1—99.6.

* * * * *

25

Please direct any questions that you have with respect to the foregoing or requests for any additional supplemental information required by the Staff to our counsel, Matthew R. Pacey of Vinson & Elkins L.L.P. at (713) 758-4786.

|

|

Very truly yours, |

|

|

|

|

|

ANTERO RESOURCES CORPORATION |

|

|

|

|

|

|

By: |

/s/ Glen C. Warren, Jr. |

|

|

Name: |

Glen C. Warren, Jr. |

|

|

Title: |

President, Chief Financial Officer and Secretary |

Enclosures

cc: Sirimal R. Mukerjee (Securities and Exchange Commission)

Shannon Buskirk (Securities and Exchange Commission)

Ethan Horowitz (Securities and Exchange Commission)

John Hodgin (Securities and Exchange Commission)

Matthew W. Strock (Vinson & Elkins L.L.P.)

Matthew R. Pacey (Vinson & Elkins L.L.P.)

Ryan J. Maierson (Latham & Watkins LLP)

Alvyn A. Schopp (Antero Resources Corporation)

26

Annex A

Supplemental Documentation for Comment #3

The cross references in the right-hand column of the below table correspond to the highlighted portions of the following sources, which are attached as exhibits to this Annex A:

Exhibit A: Standard & Poor’s Global Credit Portal: Antero Resources LLC

Exhibit B: J.P. Morgan: PD F&D and RODD

Exhibit C: Bank of America Merrill Lynch: E&P Full-Cycle Margin & Reserve Digest

Exhibit D: Barclays: Recycle Ratios (based on SEC filings of comparable companies)

Exhibit E: Credit Suisse: Small & Mid Cap Research

Exhibit F: Deutsche Bank: Natural Gas

Exhibit G: Morgan Stanley: Exploration & Production

|

Statement in Amendment No. 1 |

|

Cross

Reference(s) |

|

|

|

|

|

|

|

Pages 1 and 78: |

|

“Our management team has a proven track record of implementing geologically driven growth strategies in some of the most prominent unconventional play types across the United States, including the Barnett, Woodford, Marcellus and Utica Shales.” |

|

A-2 |

|

|

|

|

|

|

|

Pages 3 and 80: |

|

“We believe our full cycle drilling, completion and operating costs on a per unit basis are among the lowest in the Marcellus Shale and the industry as a whole.” |

|

B-3, B-4, B-5

C-7, C-11

D-1 |

|

|

|

|

|

|

|

Pages 8 and 86: |

|

“We are a low-cost leader in the development of our properties.” |

|

B-3, B-4, B-5

C-7, C-11

D-1 |

|

|

|

|

|

|

|

Pages 2 and 80: |

|

“Based on these attributes, as well as drilling results publicly released by other operators, we believe that the Marcellus Shale offers some of the most attractive single-well rates of return of all North American conventional and unconventional play types.” |

|

E-1

F-21

G-12, G-30 |

Annex B

Supplemental Documentation for Comment #9

The cross references in the right-hand column of the below table correspond to the highlighted portions of the following sources, which are attached as exhibits to this Annex B:

Exhibit A: Internal Presentation: Predictable EURs —Tight Distribution of Well Results

Exhibit B: U.S. Energy Information Administration: Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States June 2013

|

Statement in Amendment No. 1 |

|

Cross

References |

|

|

|

|

|

|

|

Pages 3 and 80: |

|

“We have experienced virtually no geologic complexity in our drilling activities to date, which has contributed to what we believe to be a narrow and predictable band of expected well recoveries per 1,000 feet of lateral length on our wells.” |

|

A-1

B-VIII-9 |