Via EDGAR and Federal Express

September 24, 2013

H.

Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549-3561

Ladies and Gentlemen:

Pursuant to discussions with the staff of the Division of Corporation Finance (the "Staff") of the Securities and Exchange Commission (the "Commission"), Antero Resources Corporation (the "Company," "we," "us" or "our") hereby confidentially submits its currently expected offering terms of the initial public offering (the "Offering") of common stock, par value $0.01 per share (the "Common Stock"), including the bona fide price range pursuant to Item 503(b)(3) of Regulation S-K, the number of shares of Common Stock to be offered, the estimated net proceeds the Company expects to receive from the Offering and the total number of shares of Common Stock to be outstanding after the Offering. The Company expects that these pricing terms will be included in a future amendment to the Registration Statement on Form S-1, File No. 333-189284 (the "Registration Statement").

The Offering terms are a bona fide estimate of the range of the minimum and maximum offering price and the maximum number of securities to be offered as of September 23, 2013. Should the bona fide estimates of these terms change, the figures presented in future amendments to the Registration Statement may increase or decrease.

The Company proposes to price the Offering with a bona fide price range of $38.00 to $42.00 per share of Common Stock, with a midpoint of $40.00 per share. In the Offering, the Company proposes to sell up to 30,000,000 shares of Common Stock. The selling stockholder has granted the underwriters a 30-day option to purchase up to an aggregate of additional 3,750,000 shares of Common Stock held by the selling stockholder to cover over-allotments. The Company has also granted the underwriters a 30-day option to purchase up to an aggregate of additional 750,000 shares of Common Stock from the Company if the underwriters sell more than an aggregate of 33,750,000 shares of common stock (including the shares purchased from the selling stockholder) to cover overallotments. As discussed with members of the Staff, this range is initially being provided for your consideration by correspondence due to the Company's and the underwriters' concern regarding providing such information in advance of the launch of the Offering given recent market volatility, as well as our desire to provide all information necessary for the Staff to complete its review on a timely basis.

1

Additionally, the Company is enclosing its proposed marked copy of those pages of the Registration Statement that will be affected by the offering terms set forth herein. These marked changes will be incorporated into a future amendment to the Registration Statement. The Company seeks confirmation from the Staff that it may launch its Offering with the price range specified herein and include such price range in a future filing of the Registration Statement.

* * * * *

[Remainder of page intentionally blank]

2

Please direct any questions that you have with respect to the foregoing to Matthew R. Pacey of Vinson & Elkins L.L.P. at (713) 758-4786.

| Very truly yours, | ||||

Antero Resources Corporation |

||||

By: |

/s/ GLEN C. WARREN, JR. |

|||

| Name: | Glen C. Warren, Jr. | |||

| Title: | President, Chief Financial Officer and Secretary | |||

Enclosures

3

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 23, 2013

PROSPECTUS

30,000,000 Shares

Antero Resources Corporation

Common Stock

This is the initial public offering of the common stock of Antero Resources Corporation. We are offering 30,000,000 shares of our common stock. The selling stockholder has granted the underwriters the option to purchase up to an additional 3,750,000 shares of common stock on the same terms and conditions if the underwriters sell more than 30,000,000 shares of common stock in this offering. We have granted the underwriters the option to purchase up to an additional 750,000 shares of common stock on the same terms and conditions if the underwriters sell more than 33,750,000 shares of common stock in this offering. Any exercise by the underwriters of their options to purchase additional shares of common stock will be made initially with respect to the 3,750,000 additional shares of common stock to be sold by the selling stockholder and then with respect to the 750,000 additional shares of common stock to be sold by us. We will not receive any proceeds from the sale of shares held by the selling stockholder. No public market currently exists for our common stock.

We have been approved to list our common stock on the New York Stock Exchange under the symbol "AR".

We anticipate that the initial public offering price will be between $38.00 and $42.00 per share.

Investing in our common stock involves risk. See "Risk Factors" beginning on page 26 of this prospectus.

| |

Per share | Total | ||

|---|---|---|---|---|

Price to the public |

$ | $ | ||

Underwriting discounts and commissions payable by us |

$ | $ | ||

Proceeds to us (before expenses) |

$ | $ |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2013.

| Barclays | Citigroup | J.P. Morgan | ||

Credit Suisse |

Jefferies |

Wells Fargo Securities |

| Morgan Stanley | Tudor, Pickering, Holt & Co. |

| Baird | BMO Capital Markets | Capital One Securities | ||

Raymond James |

Scotiabank / Howard Weil |

Credit Agricole CIB |

||

KeyBanc Capital Markets |

Mitsubishi UFJ Securities |

BB&T Capital Markets |

||

Comerica Securities |

Prospectus dated , 2013

This summary highlights some of the information contained in this prospectus and does not contain all of the information that may be important to you. You should read this entire prospectus and the documents to which we refer you before making an investment decision. You should carefully consider the information set forth under "Risk Factors," "Cautionary Statement Regarding Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical consolidated financial statements and the related notes to those financial statements included elsewhere in this prospectus. Where applicable, we have assumed an initial public offering price of $40.00 per share (the midpoint of the price range set forth on the cover page of this prospectus). Unless otherwise indicated, the information presented in this prospectus assumes that the underwriters' options to purchase additional shares of common stock are not exercised. Unless otherwise indicated, the estimated reserve volumes presented in this prospectus are based on SEC pricing at June 30, 2013 (assuming ethane rejection), as described in "—Our Properties—Reserves." Certain operational terms used in this prospectus are defined in the "Glossary of Natural Gas and Oil Terms."

In this prospectus, references to "we," "us," "our" and the "Company" refer to Antero Resources LLC and its subsidiaries before the completion of our corporate reorganization and to Antero Resources Corporation and its subsidiaries as of and following the completion of our corporate reorganization. Please see "Corporate Reorganization." References to the "selling stockholder" refer to Antero Resources Investment LLC.

Our Company

We are an independent oil and natural gas company engaged in the exploitation, development and acquisition of natural gas, NGLs and oil properties located in the Appalachian Basin in West Virginia, Ohio and Pennsylvania. We are focused on creating shareholder value through the development of our large portfolio of repeatable, low cost, liquids-rich drilling opportunities in two of the premier North American shale plays. We currently hold approximately 329,000 net acres in the southwestern core of the Marcellus Shale and approximately 102,000 net acres in the core of the Utica Shale. In addition, we estimate that approximately 170,000 net acres of our Marcellus Shale leasehold are prospective for the slightly shallower Upper Devonian Shale. As of June 30, 2013, our estimated proved, probable and possible reserves were 6.3 Tcfe, 14.0 Tcfe and 7.4 Tcfe, respectively, and our proved reserves were 23% proved developed and 91% natural gas, assuming ethane rejection. As of June 30, 2013, our drilling inventory consisted of 4,576 identified potential horizontal well locations, approximately 64% of which are liquids-rich drilling opportunities.

Our management team has a proven track record of implementing geologically driven growth strategies in some of the most prominent unconventional plays across the United States, including the Barnett, Woodford, Marcellus and Utica Shales. Paul Rady, our Chairman and Chief Executive Officer, and Glen Warren, our President and Chief Financial Officer, founded our business in 2002. The majority of our management team has worked together at various times for over 30 years at Amoco Production Company, Barrett Resources Corporation, Pennaco Energy Inc. and Antero Resources. Our management team has created significant shareholder value through various past ventures, including the sale of two unconventional resource-focused upstream companies and one midstream company in the last 15 years.

We have been successful in targeting large, repeatable resource plays where horizontal drilling and advanced fracture stimulation technologies provide the means to economically develop and produce natural gas, NGLs and oil from unconventional formations. We have been early adopters of innovative hydraulic fracturing and completion techniques, having drilled over 450 horizontal wells in the Barnett, Woodford, Marcellus and Utica Shales. As a result of our horizontal drilling and completion expertise, and the predictable geologic structure throughout our largely contiguous land position in the southwestern core of the Marcellus Shale, we have drilled approximately 1.3 million lateral feet without

1

10

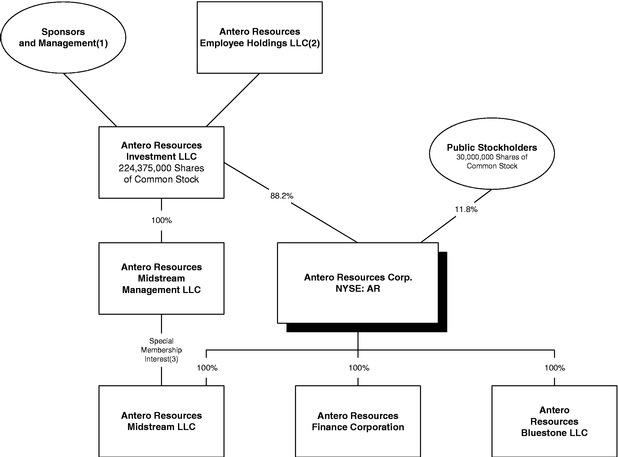

The following diagram indicates our ownership structure after giving effect to our corporate reorganization and assuming no exercise of the underwriters' options to purchase additional shares. See "Corporate Reorganization" for more information regarding our corporate reorganization.

13

Our Principal Stockholders

Following the completion of this offering and our corporate reorganization, Antero Investment will directly own 88.2% of our common stock, or 86.5% if the underwriters' options to purchase additional shares from us and Antero Investment are exercised in full. Antero Investment is primarily owned by investment funds affiliated with or managed by Warburg Pincus LLC, Yorktown Partners LLC and Trilantic Capital Partners, or collectively, the Sponsors, and certain members of our management. See "Principal and Selling Stockholders" and "Corporate Reorganization—Limited Liability Company Agreement of Antero Investment."

Warburg Pincus LLC is a leading global private equity firm focused on growth investing. The firm has more than $40 billion in assets under management. Its active portfolio of more than 125 companies is highly diversified by stage, sector and geography. Warburg Pincus is an experienced partner to management teams seeking to build durable companies with sustainable value. Founded in 1966, Warburg Pincus has raised 13 private equity funds which have invested more than $45 billion in over 675 companies in more than 35 countries. Since the late 1980s, Warburg Pincus has invested more than $6 billion in energy and natural resources companies around the world. In addition to Antero Resources LLC, notable energy investments for which the firm was lead founding investor include Bill Barrett Corporation (NYSE: BBG), Encore Acquisition Company (NYSE: EAC, since acquired by Denbury Resources), Kosmos Energy Ltd. (NYSE: KOS), Laredo Petroleum Holdings, Inc. (NYSE: LPI), MEG Energy (TSX: MEG), Newfield Exploration (NYSE: NFX), Spinnaker Exploration (NYSE: SKE, since acquired by Norsk Hydro/Statoil) and Targa Resources (NYSE: NGLS, TRGP). The firm is headquartered in New York with offices in Amsterdam, Beijing, Frankfurt, Hong Kong, London, Luxembourg, Mumbai, Port Louis, San Francisco, Sao Paulo and Shanghai.

Yorktown Partners LLC is a private investment manager investing exclusively in the energy industry with an emphasis on North American oil and gas production, and midstream businesses. Yorktown has raised 10 private equity funds totaling over $6.5 billion. Yorktown's investors include university endowments, foundations, families, insurance companies, and other institutional investors. The firm is headquartered in New York.

Trilantic Capital Partners is a global private equity firm focused on control and significant minority investments in North America and Europe with primary investment focus in the business services, consumer, energy and financial sectors. The firm currently manages four institutional private equity funds with aggregate capital commitments of $5.7 billion. Trilantic has offices in New York, London, Guernsey and Luxembourg.

Emerging Growth Company Status

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. For as long as we are an emerging growth company, unlike other public companies, we will not be required to:

14

Common stock offered by us |

30,000,000 shares. | |

Common stock to be outstanding after the offering |

254,375,000 shares (or 255,125,000 shares if the underwriters exercise their options to purchase additional shares in full). |

|

Option to purchase additional shares from the selling stockholder |

The selling stockholder has granted the underwriters a 30-day option to purchase up to an aggregate of 3,750,000 additional shares of our common stock held by the selling stockholder to cover over-allotments. |

|

Option to purchase additional shares from us |

We have granted the underwriters a 30-day option to purchase up to an aggregate of 750,000 additional shares of our common stock from us if the underwriters sell more than an aggregate of 33,750,000 shares of common stock (including the shares purchased from the selling stockholder) to cover over-allotments. |

|

|

Any exercise by the underwriters of their options to purchase additional shares of common stock will be made initially with respect to the 3,750,000 additional shares of common stock to be sold by the selling stockholder and then with respect to the 750,000 additional shares of common stock to be sold by us. |

|

Use of proceeds |

We expect to receive approximately $1.14 billion of net proceeds from the sale of the common stock offered by us after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

We intend to use the net proceeds from this offering, including any proceeds received pursuant to any exercise by the underwriters of their option to purchase additional shares of our common stock from us, to repay outstanding borrowings under our credit facility. |

|

|

We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholder pursuant to any exercise by the underwriters of their option to purchase additional shares of our common stock from the selling stockholder. |

|

|

Affiliates of certain of the underwriters are lenders under our credit facility and, accordingly, will receive a portion of the proceeds of this offering. See "Underwriting (Conflicts of Interest)." |

16

Conflicts of interest |

Because affiliates of Barclays Capital Inc., Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Wells Fargo Securities, LLC, Credit Suisse Securities (USA) LLC, BMO Capital Markets Corp., Capital One Securities, Inc., Comerica Securities, Inc. and Mitsubishi UFJ Securities (USA), Inc. are lenders under our credit facility and will each receive more than 5% of the net proceeds of this offering due to the repayment of borrowings under the credit facility, such underwriters are deemed to have a conflict of interest within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, or FINRA. Accordingly, this offering will be conducted in accordance with Rule 5121, which requires, among other things, that a "qualified independent underwriter" has participated in the preparation of, and has exercised the usual standards of "due diligence" with respect to, the registration statement and this prospectus. Jefferies LLC has agreed to act as qualified independent underwriter for this offering and to undertake the legal responsibilities and liabilities of an underwriter under the Securities Act, specifically including those inherent in Section 11 of the Securities Act. Jefferies LLC will not receive any additional fees for serving as qualified independent underwriter in connection with this offering. We have agreed to indemnify Jefferies LLC against liabilities incurred in connection with acting as a qualified independent underwriter, including liabilities under the Securities Act. See "Underwriting (Conflicts of Interest)." |

|

Dividend policy |

We do not anticipate paying any cash dividends on our common stock. In addition, our credit facility and the indentures governing our senior notes place certain restrictions on our ability to pay cash dividends. |

|

Risk factors |

You should carefully read and consider the information set forth under the heading "Risk Factors" and all other information set forth in this prospectus before deciding to invest in our common stock. |

|

Listing and trading symbol |

We have been approved to list our common stock on the New York Stock Exchange, or the NYSE, under the symbol "AR". |

The information above excludes 16,534,375 shares of common stock reserved for issuance under our 2013 Long-Term Incentive Plan, or the LTIP, that we intend to adopt in connection with the completion of this offering.

17

Antero Investment will hold a majority of our outstanding common stock.

Immediately following the completion of this offering, Antero Investment will hold approximately 88.2% of our common stock (or 86.5% if the underwriters fully exercise their options to purchase additional shares of common stock from us and Antero Investment). Accordingly, Antero Investment will have the ability to elect all of the members of our board of directors and thereby control our management and affairs. In addition, Antero Investment will be able to determine the outcome of all matters requiring stockholder approval, including mergers, amendments to our certificate of incorporation and other material transactions and will be able to cause or prevent a change in control of our company that could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company. The existence of significant stockholders may also have the effect of deterring hostile takeovers, delaying or preventing changes in control or changes in management, or limiting the ability of our other stockholders to approve transactions that they may deem to be in the best interests of our company. So long as Antero Investment continues to own a significant amount of our common stock, even if such amount represents less than 50% of the aggregate voting power, it will continue to be able to strongly influence all matters requiring stockholder approval, regardless of whether or not other stockholders believe that a potential transaction is in their own best interests.

In addition, the limited liability company agreement of Antero Investment will provide that Antero Investment and its members will agree to vote the shares of our common stock held by Antero Investment in favor of the election of the five directors of Antero Investment to our board. See "Corporate Reorganization—Limited Liability Company Agreement of Antero Investment."

Antero Investment will own a special membership interest in Antero Midstream that will provide Antero Investment with certain rights, including the right to cause an initial public offering of Antero Midstream and to prohibit our ability to sell, transfer or otherwise dispose of any portion of our midstream business or Antero Midstream without Antero Investment's consent.

Following the completion of this offering, we intend to contribute our midstream business to Antero Midstream, a newly formed limited liability company. We will own 100% of the economic interests and initially control Antero Midstream, but Antero Investment, which includes members of our management and our Sponsors, will own a special membership interest in Antero Midstream that will provide Antero Investment with certain rights, including the right to cause an initial public offering of Antero Midstream and to prohibit our ability to sell, transfer or otherwise dispose of any portion of our midstream business or Antero Midstream without Antero Investment's consent. As a result, we may not be able to manage our midstream business in a manner that will maximize its value to our stockholders. For example, we may not be able to pursue strategic dispositions of our midstream assets or determine whether to pursue an initial public offering of our midstream business when we believe it to be in the best interest of our shareholders. Following the completion of an initial public offering of Antero Midstream, Antero Investment's interest in Antero Midstream will automatically convert into a general partner interest. As a result, Antero Investment will control our current and future midstream business and may operate this business in a manner that is inconsistent with the interests of our shareholders, because those decisions will be controlled by Antero Investment and not by us. In addition, following an initial public offering of Antero Midstream, Antero Investment will have the right to receive an increasing percentage of the MLP's quarterly cash distributions in excess of specified target distribution levels. As a result, we may not receive the full economic benefit of our midstream business after an initial public offering of Antero Midstream. See "Certain Relationships and Related Party Transactions—Antero Midstream—Special Membership Interest."

37

Our amended and restated certificate of incorporation and amended and restated bylaws, as well as Delaware law, contain provisions that could discourage acquisition bids or merger proposals, which may adversely affect the market price of our common stock.

Our amended and restated certificate of incorporation authorizes our board of directors to issue preferred stock without stockholder approval. If our board of directors elects to issue preferred stock, it could be more difficult for a third party to acquire us. In addition, some provisions of our amended and restated certificate of incorporation and amended and restated bylaws could make it more difficult for a third party to acquire control of us, even if the change of control would be beneficial to our stockholders, including:

Investors in this offering will experience immediate and substantial dilution of $28.61 per share.

Based on an assumed initial public offering price of $40.00 per share, purchasers of our common stock in this offering will experience an immediate and substantial dilution of $28.61 per share in the as adjusted net tangible book value per share of common stock from the initial public offering price, and our as adjusted net tangible book value as of June 30, 2013 after giving effect to this offering would be $11.39 per share. This dilution is due in large part to earlier investors having paid substantially less than the initial public offering price when they purchased their shares. See "Dilution."

We may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield a return.

A portion of the net proceeds from this offering are expected to be used for general corporate purposes, including working capital. Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or market value. Until the net proceeds are used, they may be placed in investments that do not produce significant income or that may lose value.

We do not intend to pay dividends on our common stock, and our credit facility and the indentures governing our senior notes place certain restrictions on our ability to do so. Consequently, your only opportunity to achieve a return on your investment is if the price of our common stock appreciates.

We do not plan to declare dividends on shares of our common stock in the foreseeable future. Additionally, our credit facility and the indentures governing our senior notes place certain restrictions on our ability to pay cash dividends. Consequently, your only opportunity to achieve a return on your investment in us will be if you sell your common stock at a price greater than you paid for it. There is no guarantee that the price of our common stock that will prevail in the market will ever exceed the price that you pay in this offering.

38

Future sales of our common stock in the public market could reduce our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us.

We may sell additional shares of common stock in subsequent public offerings. We may also issue additional shares of common stock or convertible securities. After the completion of this offering, we will have 255,125,000 outstanding shares of common stock, assuming full exercise of the underwriters' options to purchase additional shares. This number includes 30,000,000 shares that we are selling in this offering, 3,750,000 shares that Antero Investment may sell in this offering if the underwriters' option to purchase additional shares from Antero Investment is fully exercised, and 750,000 shares that we may sell in this offering if the underwriters' option to purchase additional shares from us is fully exercised, which may be resold immediately in the public market. Following the completion of this offering, and assuming full exercise of the underwriters' options to purchase additional shares, Antero Investment will own 220,625,000 shares, or approximately 86.5% of our total outstanding shares, all of which are restricted from immediate resale under the federal securities laws and are subject to the lock-up agreements between the selling stockholder and the underwriters described in "Underwriting (Conflicts of Interest)," but may be sold into the market in the future.

Prior to the completion of this offering, we intend to file a registration statement with the SEC on Form S-8 providing for the registration of 16,534,375 shares of our common stock issued or reserved for issuance under our stock incentive plan. Subject to the satisfaction of vesting conditions, Rule 144 restrictions applicable to our affiliates and the expiration of lock-up agreements, shares registered under the registration statement on Form S-8 will be available for resale immediately in the public market without restriction.

We cannot predict the size of future issuances of our common stock or securities convertible into common stock or the effect, if any, that future issuances and sales of shares of our common stock will have on the market price of our common stock. Sales of substantial amounts of our common stock (including shares issued in connection with an acquisition), or the perception that such sales could occur, may adversely affect prevailing market prices of our common stock.

The underwriters of this offering may waive or release parties to the lock-up agreements entered into in connection with this offering, which could adversely affect the price of our common stock.

Antero Investment and our directors and executive officers have entered into lock-up agreements with respect to their common stock, pursuant to which they are subject to certain resale restrictions for a period of 180 days following the effectiveness date of the registration statement of which this prospectus forms a part. Barclays Capital Inc., at any time and without notice, may release all or any portion of the common stock subject to the foregoing lock-up agreements. If the restrictions under the lock-up agreements are waived, then common stock will be available for sale into the public markets, which could cause the market price of our common stock to decline and impair our ability to raise capital.

We expect to be a "controlled company" within the meaning of the NYSE rules and, as a result, will qualify for and could rely on exemptions from certain corporate governance requirements.

Upon completion of this offering, Antero Investment will control a majority of the combined voting power of all classes of our outstanding voting stock, and we expect to be a controlled company within the meaning of the NYSE corporate governance standards. Under the NYSE rules, a company of which more than 50% of the voting power is held by another person or group of persons acting together is a controlled company and may elect not to comply with certain NYSE corporate governance requirements, including the requirements that:

39

We expect to receive approximately $1.14 billion of net proceeds from the sale of the common stock offered by us after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering, including any proceeds received pursuant to any exercise by the underwriters of their option to purchase additional shares of common stock from us, to repay outstanding borrowings under our credit facility. As of June 30, 2013, we had $992 million of outstanding borrowings and letters of credit under our credit facility, which matures in May 2016 and bears interest at a variable rate, which was approximately 2.1% as of June 30, 2013. The borrowings to be repaid were incurred primarily for our drilling and development program and for general corporate purposes. While we currently do not have plans to immediately borrow additional amounts under the credit facility, we may at any time reborrow amounts repaid under the credit facility.

A $1.00 increase or decrease in the assumed initial public offering price of $40.00 per share would cause the net proceeds from this offering, after deducting the underwriting discounts and commissions and estimated offering expenses payable to us, to increase or decrease, respectively, by approximately $28.65 million. If the proceeds increase due to a higher initial public offering price, we would use the additional net proceeds to fund a portion of our capital expenditure program. If the proceeds decrease due to a lower initial public offering price, then we would reduce by a corresponding amount the net proceeds directed to repay outstanding borrowings under our credit facility.

We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholder pursuant to any exercise by the underwriters of their option to purchase additional shares of our common stock from the selling stockholder. Any exercise by the underwriters of their options to purchase additional shares of common stock will be made initially with respect to the 3,750,000 additional shares of common stock to be sold by the selling stockholder and then with respect to the 750,000 additional shares of common stock to be sold by us. We will pay all expenses related to this offering, other than underwriting discounts and commissions related to the shares sold by the selling stockholder.

Affiliates of certain of the underwriters are lenders under our credit facility and will receive a portion of the proceeds of this offering. Accordingly, this offering is being made in compliance with Rule 5121 of the FINRA. See "Underwriting (Conflicts of Interest)."

We do not anticipate declaring or paying any cash dividends to holders of our common stock in the foreseeable future. We currently intend to retain future earnings, if any, to finance the growth of our business. Our future dividend policy is within the discretion of our board of directors and will depend upon then-existing conditions, including our results of operations, financial condition, capital requirements, investment opportunities, statutory restrictions on our ability to pay dividends and other factors our board of directors may deem relevant. In addition, our credit facility and the indentures governing our senior notes place certain restrictions on our ability to pay cash dividends.

49

The following table sets forth our cash and cash equivalents and capitalization as of June 30, 2013:

This table should be read in conjunction with, and is qualified in its entirety by reference to, "Use of Proceeds" and our historical audited and unaudited consolidated financial statements and the accompanying notes appearing elsewhere in this prospectus.

| |

As of June 30, 2013 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted | |||||

| |

(in thousands) |

||||||

Cash and cash equivalents |

$ | 10,867 | $ | 191,867 | |||

Indebtedness: |

|||||||

Senior secured revolving credit facility(1) |

960,000 | — | |||||

9.375% senior notes due 2017 |

525,000 | 525,000 | |||||

7.25% senior notes due 2019 |

400,000 | 400,000 | |||||

6.00% senior notes due 2020 |

525,000 | 525,000 | |||||

9.00% senior note due 2013 |

25,000 | 25,000 | |||||

Net unamortized premium |

8,217 | 8,217 | |||||

Total indebtedness |

2,443,217 | 1,483,217 | |||||

Equity: |

|||||||

Members' equity |

1,460,947 | — | |||||

Common stock, $1.00 par value (actual); $0.01 par value (as adjusted); 1,000,000,000 shares authorized (as adjusted); 254,375,000 shares issued and outstanding (as adjusted) |

— | 2,544 | |||||

Preferred stock, $0.01 par value; 50,000,000 shares authorized (as adjusted); no shares issued and outstanding (as adjusted) |

— | — | |||||

Additional paid in capital(2) |

— | 2,861,403 | |||||

Accumulated earnings |

295,986 | 33,986 | |||||

Total equity |

1,756,933 | 2,897,933 | |||||

Total capitalization |

$ | 4,200,150 | $ | 4,381,150 | |||

50

Purchasers of the common stock in this offering will experience immediate and substantial dilution in the net tangible book value per share of the common stock for accounting purposes. Our net tangible book value as of June 30, 2013, after giving effect to the transactions described under "Corporate Reorganization," was $1.76 billion, or $7.83 per share. Pro forma net tangible book value per share is determined by dividing our pro forma tangible net worth (tangible assets less total liabilities) by the total number of outstanding shares of common stock that will be outstanding immediately prior to the closing of this offering including giving effect to our corporate reorganization. After giving effect to the sale of the shares in this offering and further assuming the receipt of the estimated net proceeds (after deducting estimated underwriting discounts and commissions and estimated offering expenses), our adjusted pro forma net tangible book value as of June 30, 2013 would have been approximately $2.90 billion, or $11.39 per share. This represents an immediate increase in the net tangible book value of $3.56 per share to our existing stockholders and an immediate dilution (i.e., the difference between the offering price and the adjusted pro forma net tangible book value after this offering) to new investors purchasing shares in this offering of $28.61 per share. The following table illustrates the per share dilution to new investors purchasing shares in this offering:

Assumed initial public offering price per share |

$ | 40.00 | |||||

Pro forma net tangible book value per share as of June 30, 2013 (after giving effect to our corporate reorganization) |

$ | 7.83 | |||||

Increase per share attributable to new investors in this offering |

3.56 | ||||||

As adjusted pro forma net tangible book value per share after giving effect to our corporate reorganization and this offering |

11.39 | ||||||

Dilution in pro forma net tangible book value per share to new investors in this offering |

$ | 28.61 | |||||

The following table summarizes, on an adjusted pro forma basis as of June 30, 2013, the total number of shares of common stock owned by existing stockholders and to be owned by new investors, the total consideration paid, and the average price per share paid by our existing stockholders and to be paid by new investors in this offering at $40.00, the midpoint of the range of the initial public offering price set forth on the cover page of this prospectus, calculated before deduction of estimated underwriting discounts and commissions:

| |

Shares Acquired | Total Consideration | Average Price Per Share |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number | Percent | Amount | Percent | ||||||||||||

| |

|

|

(in thousands) |

|

|

|||||||||||

Existing stockholders(1) |

224,375,000 | 88.2 | % | $ | 1,756,933 | 59.4 | % | $ | 7.83 | |||||||

New investors in this offering |

30,000,000 | 11.8 | 1,200,000 | 40.6 | $ | 40.00 | ||||||||||

Total |

254,375,000 | 100.0 | % | $ | 2,956,933 | 100.0 | % | |||||||||

A $1.00 increase or decrease in the assumed initial public offering price of $40.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus, would increase or decrease our as adjusted pro forma net tangible book value as of June 30, 2013 by approximately $28.65 million, the as adjusted pro forma net tangible book value per share after this offering by $0.11 per share and the dilution in pro forma as adjusted net tangible book value per share to new investors in this offering by $0.89 per share, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

51

2012, we completed a reorganization of our legal structure by contributing all of the outstanding shares owned by Antero Resources LLC in each of the Antero Arkoma, Antero Piceance and Antero Pipeline corporations to Antero Appalachian. Antero Arkoma, Antero Piceance, and Antero Pipeline were first converted to limited liability companies and then liquidated as part of the reorganization. As a result, for income tax purposes, the operations subsequent to the reorganizations and tax attributes of Arkoma, Piceance and Pipeline are now combined with Antero Appalachian for tax reporting purposes. Our subsidiaries are subject to state and federal income taxes but are currently not in a tax paying position for regular federal income taxes, primarily due to the current deductibility of intangible drilling costs and the deferral of unrealized commodity hedge gains for tax purposes until they are realized. We do pay some state income or franchise taxes where state income or franchise taxes are determined on a basis other than income. We have generated net operating loss carryforwards that expire at various dates from 2024 through 2032. We have recognized the value of these net operating losses to the extent of our deferred tax liabilities. We recorded valuation allowances for deferred tax assets at December 31, 2012 of approximately $48 million primarily for capital loss and state loss carryforwards for which we do not believe we will realize a benefit. The amount of deferred tax assets considered realizable, however, could change in the near term as we generate taxable income or estimates of future taxable income are reduced.

The calculation of our tax liabilities involves uncertainties in the application of complex tax laws and regulations. We give financial statement recognition to those tax positions that we believe are more likely than not to be sustained upon examination by the Internal Revenue Service or state revenue authorities. The financial statements included unrecognized benefits at December 31, 2012 and June 30, 2013 of $15 million that, if recognized, would result in a reduction of other long-term liabilities and an increase in noncurrent deferred tax liabilities. No impact to our 2012 effective tax rate would result from the recognition of the tax benefits. As of June 30, 2013, we have accrued $0.4 million of interest expense on unrecognized tax benefits.

Corporate Reorganization

The limited liability company agreement of Antero Investment to be adopted in connection with the closing of this offering provides a mechanism by which the shares of our common stock to be allocated amongst the members of Antero Investment, including Antero Resources Employee Holdings LLC, or Employee Holdings, will be determined. As a result, the satisfaction of all performance, market, and service conditions relative to the membership interests awards held by Employee Holdings will be probable. Accordingly, we will recognize approximately $262.0 million in a non-cash charge for stock compensation expense for the estimated fair value of the prospective distributions to Employee Holdings at the closing of this offering and an additional $147.5 million over the remaining service period. The charge will not have a dilutive effect on the pro forma as adjusted net tangible book value per share to new investors in this offering.

We will retain an independent valuation firm to estimate the fair value of the shares to be distributed in satisfaction of the profits interests which will be charged to expense at the closing of this offering and over the remaining service period, respectively. Because consideration for the membership interests awards will be deemed given by Antero Investment, the charge to expense will be accounted for as a capital contribution by Antero Investment to us and credited to additional paid-in capital.

60

94

Employment, Severance or Change in Control Agreements

We do not maintain any employment, severance or change in control agreements with any of our Named Executive Officers. In addition, none of the Named Executive Officers are entitled to any payments or other benefits in connection with a termination of their employment or a change in control.

Long-Term Incentive Plan

Prior to the completion of this offering, our board of directors will have adopted, and our stockholders will have approved, a Long-Term Incentive Plan, or LTIP, to attract and retain employees and directors. The description of the LTIP set forth below is a summary of the material features of the LTIP. This summary, however, does not purport to be a complete description of all of the provisions of the LTIP and is qualified in its entirety by reference to the LTIP, a copy of which is filed as an exhibit to this registration statement. The LTIP provides for the grant of equity-based awards, including options to purchase shares of our common stock, stock appreciation rights, restricted stock, restricted stock units, bonus stock, dividend equivalents, other stock-based awards and performance awards.

Share Limits. Subject to adjustment in accordance with the LTIP, 16,534,375 shares of our common stock will initially be reserved for issuance pursuant to awards under the LTIP. However, no more than 8,000,000 shares of our common stock in the aggregate may be issued pursuant to incentive stock options (which generally are stock options that meet the requirements of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code")). The maximum number of shares of our common stock that may be subject to one or more awards granted to any one participant during any 12-month period that are intended to qualify as "performance-based compensation" under Section 162(m) of the Code shall be 1,000,000 shares with respect to stock options and stock appreciation rights and 7,000,000 shares with respect to any other awards. Further, the maximum aggregate amount that may be paid in cash to any one participant in any calendar year with respect to one or more awards payable in cash that are intended to qualify as "performance-based compensation" under Section 162(m) of the Code shall be $10,000,000. The maximum aggregate grant date fair value of awards granted to a non-employee director during any calendar year shall be $350,000 (or $500,000 in the first year in which an individual becomes a non-employee director). Common stock subject to an award that expires or is canceled, forfeited, exchanged, settled in cash or otherwise terminated and shares withheld to pay the exercise price of, or to satisfy the withholding obligations with respect to, an award will again be available for delivery in connection with awards under the LTIP.

Administration. The LTIP will be administered by the compensation committee of our board of directors, which is referred to herein as the "committee," except in the event our board of directors chooses to administer the LTIP. Unless otherwise determined by our board of directors, the committee will be comprised of two or more individuals, each of whom qualifies as an "outside director" as defined in Section 162(m) of the Code and a "nonemployee director" as defined in Rule 16b-3 under the Exchange Act. Subject to the terms and conditions of the LTIP, the committee has broad discretion to administer the LTIP, including the power to determine the employees and directors to whom awards will be granted, to determine the type of awards to be granted and the number of shares to be subject to awards and the terms and conditions of awards, to determine and interpret the terms and provisions of each award agreement, to accelerate the vesting or exercise of any award and to make all other determinations and to take all other actions necessary or advisable for the administration of the LTIP.

Eligibility. The committee will determine the employees and members of our board of directors who are eligible to receive awards under the LTIP.

Stock Options. The committee may grant incentive stock options and options that do not qualify as incentive stock options, except that incentive stock options may only be granted to persons who are our employees or employees of one of our subsidiaries, in accordance with Section 422 of the Code.

132

PRINCIPAL AND SELLING STOCKHOLDERS

Beneficial Ownership

The following table sets forth information with respect to the beneficial ownership of our common stock as of September 23, 2013 after giving effect to our corporation reorganization by:

Except as otherwise noted, the person or entities listed below have sole voting and investment power with respect to all shares of our common stock beneficially owned by them, except to the extent this power may be shared with a spouse. All information with respect to beneficial ownership has been furnished by the respective directors, officers or 5% or more stockholders, as the case may be. Unless otherwise note, the mailing address of each person or entity named in the table is 1625 17th Street, Denver, Colorado, 80202.

The selling stockholder has granted the underwriters the option to purchase up to an additional 3,750,000 shares of common stock and will sell shares only to the extent such option is exercised. The number of shares being offered by the selling stockholder in the table below assumes a full exercise of the underwriters' option to purchase additional shares of common stock.

| |

Shares Beneficially Owned Prior to the Offering(1) |

|

Shares Beneficially Owned After Offering |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Being Offered |

|||||||||||||||

Name and Address of Beneficial Owner

|

Number | Percentage | Number | Percentage | ||||||||||||

Antero Resources Investment LLC(2) |

224,375,000 | 100.0 | % | 3,750,000 | 220,625,000 | 86.5 | % | |||||||||

Peter R. Kagan(3) |

— | — | — | — | — | |||||||||||

W. Howard Keenan, Jr.(3) |

— | — | — | — | — | |||||||||||

Christopher R. Manning(3) |

— | — | — | — | — | |||||||||||

Richard W. Connor(3) |

— | — | — | — | — | |||||||||||

Robert J. Clark(3) |

— | — | — | — | — | |||||||||||

Benjamin A. Hardesty(3) |

— | — | — | — | — | |||||||||||

James R. Levy(3) |

— | — | — | — | — | |||||||||||

Paul M. Rady |

— | — | — | — | — | |||||||||||

Glen C. Warren, Jr. |

— | — | — | — | — | |||||||||||

Kevin J. Kilstrom |

— | — | — | — | — | |||||||||||

Alvyn A. Schopp |

— | — | — | — | — | |||||||||||

Directors and executive officers as a group (12 persons) |

— | — | — | — | — | |||||||||||

144

Associates LLC is the sole general partner of Yorktown VII Company LP. Yorktown VIII Company LP is the sole general partner of Yorktown Energy Partners VIII, L.P. Yorktown VIII Associates LLC is the sole general partner of Yorktown VIII Company LP. The managers of each of Yorktown V Company LLC, Yorktown VI Associates LLC, Yorktown VII Associates LLC and Yorktown VIII Associates LLC, who act by majority approval, are Bryan H. Lawrence, W. Howard Keenan, Jr., Peter A. Leidel, Tomás R. LaCosta and Robert A. Signorino. As a result, Yorktown V Company LLC, Yorktown VI Associates LLC, Yorktown VII Associates LLC, Yorktown VIII Associates LLC and their respective managers may be deemed to share the power to vote or direct the vote or dispose or direct the disposition of the voting interests in Antero Investment owned by the Yorktown funds. Such Yorktown funds disclaim beneficial ownership of the shares of common stock held by Antero Investment, except to the extent of their pecuniary interest therein. Yorktown V Company LLC, Yorktown VI Associates LLC, Yorktown VII Associates LLC, Yorktown VIII Associates LLC and their respective managers disclaim beneficial ownership of all shares of common stock held by Antero Investment.

Trilantic Capital Partners Fund III Onshore Rollover L.P., Trilantic Capital Partners AIV I L.P., Trilantic Capital Partners Fund AIV I L.P., Trilantic Capital Partners Fund (B) AIV I L.P., TCP Capital Partners V AIV I L.P., Trilantic Capital Partners IV L.P., Trilantic Capital Partners Group VI L.P., Trilantic Capital Partners Fund IV Funded Rollover L.P., TCP Capital Partners VI L.P. (collectively, "Trilantic Capital Partners") and LB DPEF 2004 Partners L.P. ("DPEF") will collectively and indirectly own 8.5% of the voting interests in Antero Investment. The holdings of Trilantic Capital Partners and DPEF are held by TCP Antero I-1 Holdco, LLC, which is managed by Trilantic Capital Management LLC ("TCM") as managing member; TCP Antero I-2 Holdco, LLC and TCP Antero I-4 Holdco, LLC, are each managed by Trilantic Capital Partners IV L.P. as managing member. TCP Antero I-1 Holdco, LLC, TCP Antero I-2 Holdco, LLC and TCP Antero I-4 Holdco, LLC (collectively, the "Trilantic Entities") will have the right to appoint one director of Antero Investment. TCM, the investment adviser of Trilantic Capital Partners, as well as Charles Ayres, E. Daniel James, Christopher R. Manning, Jon Mattson and Charles C. Moore (collectively, the "Trilantic Partners") as partners, members of the Board of Managers and majority owners of TCM, may be deemed to share voting and dispositive power of the voting interests in Antero Investment owned by Trilantic Capital Partners. Trilantic Capital Partners and DPEF disclaim beneficial ownership of the shares of common stock, except to the extent of their pecuniary interest. TCM and the Trilantic Partners disclaim beneficial ownership of all shares held by the Trilantic Entities.

146

Upon completion of this offering, the authorized capital stock of Antero Resources Corporation will consist of 1,000,000,000 shares of common stock, $0.01 par value per share, of which 254,375,000 shares will be issued and outstanding, and 50,000,000 shares of preferred stock, $0.01 par value per share, of which no shares will be issued and outstanding.

The following summary of the capital stock and amended and restated certificate of incorporation and amended and restated bylaws of Antero Resources Corporation does not purport to be complete and is qualified in its entirety by reference to the provisions of applicable law and to our amended and restated certificate of incorporation and amended and restated bylaws, which are filed as exhibits to the registration statement of which this prospectus is a part.

Common Stock

Except as provided by law or in a preferred stock designation, holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, will have the exclusive right to vote for the election of directors and do not have cumulative voting rights. Except as otherwise required by law, holders of common stock, are not entitled to vote on any amendment to the amended and restated certificate of incorporation (including any certificate of designations relating to any series of preferred stock) that relates solely to the terms of any outstanding series of preferred stock if the holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to the amended and restated certificate of incorporation (including any certificate of designations relating to any series of preferred stock) or pursuant to the DGCL. Subject to prior rights and preferences that may be applicable to any outstanding shares or series of preferred stock, holders of common stock are entitled to receive ratably in proportion to the shares of common stock held by them such dividends (payable in cash, stock or otherwise), if any, as may be declared from time to time by our board of directors out of funds legally available for dividend payments. All outstanding shares of common stock are fully paid and non-assessable, and the shares of common stock to be issued upon completion of this offering will be fully paid and non-assessable. The holders of common stock have no preferences or rights of conversion, exchange, pre-emption or other subscription rights. There are no redemption or sinking fund provisions applicable to the common stock. In the event of any voluntary or involuntary liquidation, dissolution or winding-up of our affairs, holders of common stock will be entitled to share ratably in our assets in proportion to the shares of common stock held by them that are remaining after payment or provision for payment of all of our debts and obligations and after distribution in full of preferential amounts to be distributed to holders of outstanding shares of preferred stock, if any.

Preferred Stock

Our amended and restated certificate of incorporation authorizes our board of directors, subject to any limitations prescribed by law, without further stockholder approval, to establish and to issue from time to time one or more classes or series of preferred stock, par value $0.01 per share, covering up to an aggregate of 50,000,000 shares of preferred stock. Each class or series of preferred stock will cover the number of shares and will have the powers, preferences, rights, qualifications, limitations and restrictions determined by the board of directors, which may include, among others, dividend rights, liquidation preferences, voting rights, conversion rights, preemptive rights and redemption rights. Except as provided by law or in a preferred stock designation, the holders of preferred stock will not be entitled to vote at or receive notice of any meeting of stockholders.

147

SHARES ELIGIBLE FOR FUTURE SALE

Prior to this offering, there has been no public market for our common stock. Future sales of our common stock in the public market, or the availability of such shares for sale in the public market, could adversely affect the market price of our common stock prevailing from time to time. As described below, only a limited number of shares will be available for sale shortly after this offering due to contractual and legal restrictions on resale. Nevertheless, sales of a substantial number of shares of our common stock in the public market after such restrictions lapse, or the perception that those sales may occur, could adversely affect the prevailing market price of our common stock at such time and our ability to raise equity-related capital at a time and price we deem appropriate.

Sales of Restricted Shares

Upon the closing of this offering, we will have outstanding an aggregate of 254,375,000 shares of common stock. Of these shares, all of the 30,000,000 shares of common stock to be sold in this offering will be freely tradable without restriction or further registration under the Securities Act, unless the shares are held by any of our "affiliates" as such term is defined in Rule 144 under the Securities Act. All remaining shares of common stock held by existing stockholders will be deemed "restricted securities" as such term is defined under Rule 144. The restricted securities were issued and sold by us in private transactions and are eligible for public sale only if registered under the Securities Act or if they qualify for an exemption from registration under Rule 144 or Rule 701 under the Securities Act, which rules are summarized below.

As a result of the lock-up agreements described below and the provisions of Rule 144 and Rule 701 under the Securities Act, the shares of our common stock (excluding the shares to be sold in this offering) that will be available for sale in the public market are as follows:

Lock-up Agreements

We, all of our directors and officers and Antero Investment have agreed not to sell any common stock for a period of 180 days from the date of this prospectus, subject to certain exceptions and extensions. See "Underwriting (Conflicts of Interest)" for a description of these lock-up provisions.

Rule 144

In general, under Rule 144 under the Securities Act as currently in effect, a person (or persons whose shares are aggregated) who is not deemed to have been an affiliate of ours at any time during the three months preceding a sale, and who has beneficially owned restricted securities within the meaning of Rule 144 for a least sixth months (including any period of consecutive ownership of preceding non-affiliated holders) would be entitled to sell those shares, subject only to the availability of current public information about us. A non-affiliated person who has beneficially owned restricted securities within the meaning of Rule 144 for at least one year would be entitled to sell those shares without regard to the provisions of Rule 144.

151

UNDERWRITING (CONFLICTS OF INTEREST)

Barclays Capital Inc., Citigroup Global Markets Inc. and J.P. Morgan Securities LLC are acting as the representatives of the underwriters and the joint book-running managers of this offering. Under the terms of an underwriting agreement, which has been filed as an exhibit to the registration statement of which this prospectus forms a part, each of the underwriters named below has severally agreed to purchase from us the respective number of shares of common stock shown opposite its name below:

Underwriters

|

Number of Shares |

|||

|---|---|---|---|---|

Barclays Capital Inc. |

||||

Citigroup Global Markets Inc. |

||||

J.P. Morgan Securities LLC |

||||

Credit Suisse Securities (USA) LLC |

||||

Jefferies LLC |

||||

Wells Fargo Securities, LLC |

||||

Morgan Stanley & Co. LLC |

||||

Tudor, Pickering, Holt & Co. Securities, Inc. |

||||

Robert W. Baird & Co. Incorporated |

||||

BMO Capital Markets Corp. |

||||

Capital One Securities, Inc. |

||||

Raymond James & Associates, Inc. |

||||

Scotia Capital (USA) Inc. |

||||

Credit Agricole Securities (USA) Inc. |

||||

KeyBanc Capital Markets Inc. |

||||

Mitsubishi UFJ Securities (USA), Inc. |

||||

BB&T Capital Markets, a division of BB&T Securities, LLC |

||||

Comerica Securities, Inc. |

||||

Total |

30,000,000 | |||

The underwriting agreement will provide that the underwriters' obligation to purchase shares of common stock depends on the satisfaction of the conditions contained in the underwriting agreement, including:

Commissions and Expenses

The following table summarizes the underwriting discounts and commissions we and the selling stockholder will pay to the underwriters. These amounts are shown assuming both no exercise and full exercise of the underwriters' options to purchase additional shares. The underwriting fee is the

157

difference between the initial price to the public and the amount the underwriters pay to us and the selling stockholder for the shares.

| |

Paid by the Company | ||||||

|---|---|---|---|---|---|---|---|

| |

No Exercise | Full Exercise | |||||

Per share |

|||||||

Total |

|||||||

| |

Paid by the Selling Stockholder | ||||||

|---|---|---|---|---|---|---|---|

| |

No Exercise | Full Exercise | |||||

Per share |

|||||||

Total |

|||||||

The representatives of the underwriters have advised us that the underwriters propose to offer the shares of common stock directly to the public at the public offering price on the cover page of this prospectus and to selected dealers, which may include the underwriters, at such offering price less a selling concession not in excess of $ per share. After this offering, the representatives may change the offering price and other selling terms. Sales of shares made outside of the United States may be made by affiliates of the underwriters.

The expenses of this offering that are payable by us are estimated to be approximately $5.0 million (excluding underwriting discounts and commissions). We have agreed to pay expenses incurred by the selling stockholder in connection with this offering, other than the underwriting discounts and commissions.

Options to Purchase Additional Shares

The selling stockholder has granted the underwriters an option exercisable for 30 days after the date of this prospectus, to purchase, from time to time, in whole or in part, up to an aggregate of 3,750,000 shares from the selling stockholder at the public offering price less underwriting discounts and commissions. This option may be exercised if the underwriters sell more than 30,000,000 shares in connection with this offering. We have granted the underwriters an option exercisable for 30 days after the date of this prospectus, to purchase, from time to time, in whole or in part, up to an aggregate of 750,000 shares at the public offering price less underwriting discounts and commissions. This option may be exercised if the underwriters sell more than 33,750,000 shares in connection with this offering. Any exercise by the underwriters of their options to purchase additional shares of common stock will be made initially with respect to the 3,750,000 additional shares of common stock to be sold by the selling stockholder and then with respect to the 750,000 additional shares of common stock to be sold by us. To the extent that the options are exercised, each underwriter will be obligated, subject to certain conditions, to purchase its pro rata portion of these additional shares based on the underwriter's underwriting commitment in this offering as indicated in the table at the beginning of this "Underwriting (Conflicts of Interest)" section.

Lock-Up Agreements

We, the selling stockholder and all of our directors and executive officers have agreed that, subject to certain exceptions, without the prior written consent of Barclays Capital Inc., we and they will not directly or indirectly, (1) offer for sale, sell, pledge or otherwise dispose of (or enter into any transaction or device that is designed to, or could be expected to, result in the disposition by any person at any time in the future of) any shares of common stock (other than common stock and shares issued pursuant to employee benefit plans, qualified stock option plans or other employee compensation plans existing on the date of this prospectus or described herein) or sell or grant options,

158

ANTERO RESOURCES LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

Three Months ended

June 30, 2012 and 2013

(Unaudited)

(In thousands)

| |

2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|

Revenue: |

|||||||

Natural gas sales |

$ | 44,688 | 172,332 | ||||

Natural gas liquids sales |

— | 17,244 | |||||

Oil sales |

277 | 2,085 | |||||

Realized and unrealized gain (loss) on derivative instruments (including unrealized gains (losses) of $(55,904) and $181,337 in 2012 and 2013, respectively) |

(6,040 | ) | 195,483 | ||||

Total revenue |

38,925 | 387,144 | |||||

Operating expenses: |

|||||||

Lease operating expenses |

1,866 | 1,454 | |||||

Gathering, compression, processing, and transportation |

20,079 | 48,670 | |||||

Production taxes |

3,371 | 10,108 | |||||

Exploration expenses |

2,952 | 7,300 | |||||

Impairment of unproved properties |

1,295 | 4,803 | |||||

Depletion, depreciation, and amortization |

22,321 | 52,589 | |||||

Accretion of asset retirement obligations |

24 | 267 | |||||

General and administrative |

10,473 | 13,567 | |||||

Total operating expenses |

62,381 | 138,758 | |||||

Operating income (loss) |

(23,456 | ) | 248,386 | ||||

Interest expense |

(24,223 | ) | (33,468 | ) | |||

Income (loss) from continuing operations before income taxes and discontinued operations |

(47,679 | ) | 214,918 | ||||

Income tax (expense) benefit |

14,442 | (83,725 | ) | ||||

Income (loss) from continuing operations |

(33,237 | ) | 131,193 | ||||

Discontinued operations: |

|||||||

Loss from results of operations and sale of discontinued operations |

(444,850 | ) | — | ||||

Net income (loss) and comprehensive income (loss) attributable to Antero equity owners |

$ | (478,087 | ) | 131,193 | |||

Pro forma information |

|||||||

Pro forma earnings (loss) per common share—basic |

|||||||

Continuing operations |

$ | (0.13 | ) | $ | 0.52 | ||

Discontinued operations |

$ | (1.75 | ) | — | |||

Net income (loss) |

$ | (1.88 | ) | $ | 0.52 | ||

Pro forma earnings (loss) per common share—diluted |

|||||||

Continuing operations |

$ | (0.13 | ) | $ | 0.52 | ||

Discontinued operations |

$ | (1.75 | ) | — | |||

Net income (loss) |

$ | (1.88 | ) | $ | 0.52 | ||

Pro forma weighted average number of shares outstanding: |

|||||||

Basic |

254,375,000 | 254,375,000 | |||||

Diluted |

254,375,000 | 254,375,000 | |||||

See accompanying notes to condensed consolidated financial statements.

F-3

ANTERO RESOURCES LLC AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

Six Months ended June 30,

2012 and 2013

(Unaudited)

(In thousands)

| |

2012 | 2013 | |||||

|---|---|---|---|---|---|---|---|

Revenue: |

|||||||

Natural gas sales |

$ | 89,822 | 294,278 | ||||

Natural gas liquids sales |

— | 27,816 | |||||

Oil sales |

325 | 2,962 | |||||

Realized and unrealized gain on derivative instruments (including unrealized gains of $114,498 and $61,265 in 2012 and 2013, respectively) |

211,214 | 123,542 | |||||

Gain on sale of gathering system |

291,305 | — | |||||

Total revenue |

592,666 | 448,598 | |||||

Operating expenses: |

|||||||

Lease operating expenses |

2,559 | 2,525 | |||||

Gathering, compression, processing, and transportation |

31,654 | 89,640 | |||||

Production taxes |

7,113 | 18,727 | |||||

Exploration expenses |

4,756 | 11,662 | |||||

Impairment of unproved properties |

1,581 | 6,359 | |||||

Depletion, depreciation, and amortization |

38,431 | 92,953 | |||||

Accretion of asset retirement obligations |

46 | 531 | |||||

General and administrative |

19,646 | 26,284 | |||||

Total operating expenses |

105,786 | 248,681 | |||||

Operating income |

486,880 | 199,917 | |||||

Interest expense |

(48,593 | ) | (63,396 | ) | |||

Income from continuing operations before income taxes and discontinued operations |

438,287 | 136,521 | |||||

Income tax expense |

(183,969 | ) | (53,325 | ) | |||

Income from continuing operations |

254,318 | 83,196 | |||||

Discontinued operations: |

|||||||

Loss from results of operations and sale of discontinued operations |

(404,674 | ) | — | ||||

Net income (loss) and comprehensive income (loss) attributable to Antero equity owners |

$ | (150,356 | ) | 83,196 | |||

Pro forma information |

|||||||

Pro forma earnings (loss) per common share—basic |

|||||||

Continuing operations |

$ | 1.00 | $ | 0.33 | |||

Discontinued operations |

$ | (1.59 | ) | — | |||

Net income (loss) |

$ | (0.59 | ) | $ | 0.33 | ||

Pro forma earnings (loss) per common share—diluted |

|||||||

Continuing operations |

$ | 1.00 | $ | 0.33 | |||

Discontinued operations |

$ | (1.59 | ) | — | |||

Net income (loss) |

$ | (0.59 | ) | $ | 0.33 | ||

Pro forma weighted average number of shares outstanding: |

|||||||

Basic |

254,375,000 | 254,375,000 | |||||

Diluted |

254,375,000 | 254,375,000 | |||||

See accompanying notes to condensed consolidated financial statements.

F-4

ANTERO RESOURCES LLC AND SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss)

Years ended December 31, 2010, 2011

and 2012

(In thousands)

| |

2010 | 2011 | 2012 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Revenue: |

||||||||||

Natural gas sales |

$ | 47,392 | 195,116 | 259,743 | ||||||

Natural gas liquids sales |

— | — | 3,719 | |||||||

Oil sales |

39 | 173 | 1,520 | |||||||

Realized and unrealized gains on commodity derivative instruments (including unrealized gains of $62,536, $446,120 and $1,055 in 2010, 2011, and 2012, respectively) |

77,599 | 496,064 | 179,546 | |||||||

Gain on sale of gathering system |

— | — | 291,190 | |||||||

Total revenue |

125,030 | 691,353 | 735,718 | |||||||

Operating expenses: |

||||||||||

Lease operating expenses |

1,158 | 4,608 | 6,243 | |||||||

Gathering, compression, and transportation |

9,237 | 37,315 | 91,094 | |||||||

Production taxes |

2,885 | 11,915 | 20,210 | |||||||

Exploration expenses |

2,350 | 4,034 | 14,675 | |||||||

Impairment of unproved properties |

6,076 | 4,664 | 12,070 | |||||||

Depletion, depreciation, and amortization |

18,522 | 55,716 | 102,026 | |||||||

Accretion of asset retirement obligations |

11 | 76 | 101 | |||||||

Expenses related to business acquisition |

2,544 | — | — | |||||||

General and administrative |

21,952 | 33,342 | 45,284 | |||||||

Loss on sale of assets |

— | 8,700 | — | |||||||

Total operating expenses |

64,735 | 160,370 | 291,703 | |||||||

Operating income |

60,295 | 530,983 | 444,015 | |||||||

Other expense: |

||||||||||

Interest expense |

(56,463 | ) | (74,404 | ) | (97,510 | ) | ||||

Realized and unrealized losses on interest derivative instruments, net (including unrealized gains of $6,875 and $4,212 in 2010 and 2011, respectively) |

(2,677 | ) | (94 | ) | — | |||||

Total other expense |

(59,140 | ) | (74,498 | ) | (97,510 | ) | ||||

Income from continuing operations before income taxes and discontinued operations |

1,155 | 456,485 | 346,505 | |||||||

Provision for income taxes |

(939 | ) | (185,297 | ) | (121,229 | ) | ||||

Income from continuing operations |

216 | 271,188 | 225,276 | |||||||

Discontinued operations: |

||||||||||

Income (loss) from results of operations and sale of discontinued operations, net of income tax (expense) benefit of $(29,070), $(45,155), and $272,553 in 2010, 2011, and 2012, respectively |

228,412 | 121,490 | (510,345 | ) | ||||||

Net income (loss) and comprehensive income (loss) attributable to Antero equity owners |

$ | 228,628 | 392,678 | (285,069 | ) | |||||

Pro forma information |

||||||||||

Pro forma earnings (loss) per common share—basic |

||||||||||

Continuing operations |

— | * | $ | 1.07 | $ | 0.89 | ||||

Discontinued operations |

$ | 0.90 | $ | 0.48 | $ | (2.01 | ) | |||

Net income (loss) |

$ | 0.90 | $ | 1.54 | $ | (1.12 | ) | |||

Pro forma earnings (loss) per common share—diluted |

||||||||||

Continuing operations |

— | * | $ | 1.07 | $ | 0.89 | ||||

Discontinued operations |

$ | 0.90 | $ | 0.48 | $ | (2.01 | ) | |||

Net income (loss) |

$ | 0.90 | $ | 1.54 | $ | (1.12 | ) | |||

Pro forma weighted average number of shares outstanding: |

||||||||||

Basic |

254,375,000 | 254,375,000 | 254,375,000 | |||||||

Diluted |

254,375,000 | 254,375,000 | 254,375,000 | |||||||

|

||||||||||

* Less than $0.01 per share. |

||||||||||

See accompanying notes to consolidated financial statements.

F-22

30,000,000 Shares

Antero Resources Corporation

Common Stock

Prospectus

, 2013

Barclays

Citigroup

J.P. Morgan

Credit Suisse

Jefferies

Wells Fargo Securities

Morgan Stanley

Tudor, Pickering, Holt & Co.

Baird

BMO Capital Markets

Capital One Securities

Raymond James

Scotiabank / Howard Weil

Credit Agricole CIB

KeyBanc Capital Markets

Mitsubishi UFJ Securities

BB&T Capital Markets

Comerica Securities

Through and including , (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.